What HR Teams Should Know About COBRA

When someone leaves your company, whether they quit or get laid off, one of the last things on either of your minds might be health insurance. But for HR and benefits teams, this is when COBRA continuing coverage responsibilities kick in—it's a test of how well your processes really work under pressure.

In This Article

We work with COBRA every day, so we know it’s not the most exciting part of employee benefits. Nevertheless, managing continuing coverage is necessary, and when done properly, it gives former employees and their families a much-needed sense of stability during uncertain times. In this post, we’ll break down what COBRA is, why it matters, and what your team needs to do to stay compliant.

What is COBRA?

The acronym COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. It’s a federal law passed in the 1980s that allows employees and their families to continue using their group health insurance after something happens that would normally cause them to lose it.

Think of it as a safety net. If an employee gets laid off, has their hours cut, gets divorced, or passes away, COBRA ensures that they (or their family members) can keep the same health plan for a while—at their own cost. It doesn’t create new coverage. It just lets them stay on what they had.

When does COBRA apply?

Continuing coverage through COBRA kicks in after what's called a qualifying event. These are life changes that would normally cause someone to lose their health insurance. The most common ones we see are when an employee leaves the company (either voluntarily or involuntarily), has their hours reduced, or experiences a divorce or death in the family. Even kids aging out of a parent’s plan can trigger COBRA rights.

If the employee was covered under your group health plan the day before the event happened, they’re probably eligible to continue it under COBRA.

How long does coverage last?

For most employees who lose coverage because of termination or reduced hours, COBRA lasts up to 18 months. In some cases—like when a second qualifying event happens or someone becomes disabled—that period can be extended to 29 or even 36 months, especially for spouses and dependents.

The timeframes are set by law, and it’s important to track them carefully so that people aren’t dropped too early (or kept on longer than allowed).

Who pays for COBRA?

This one surprises a lot of people. COBRA isn’t free. The individual who elects to continue their coverage has to pay the full cost of the health plan—including the portion the employer used to pay. On top of that, there’s usually a small administrative fee, bringing the total cost to about 102% of the premium.

That might seem expensive, but for someone going through a tough time—like a job loss—it often beats going without insurance altogether. It gives them time to figure out their next move while still having access to care.

What does HR need to do?

Here’s where it gets a bit more detailed. Employers (or whoever is handling continuing coverage for them) are responsible for making sure everything happens on time.

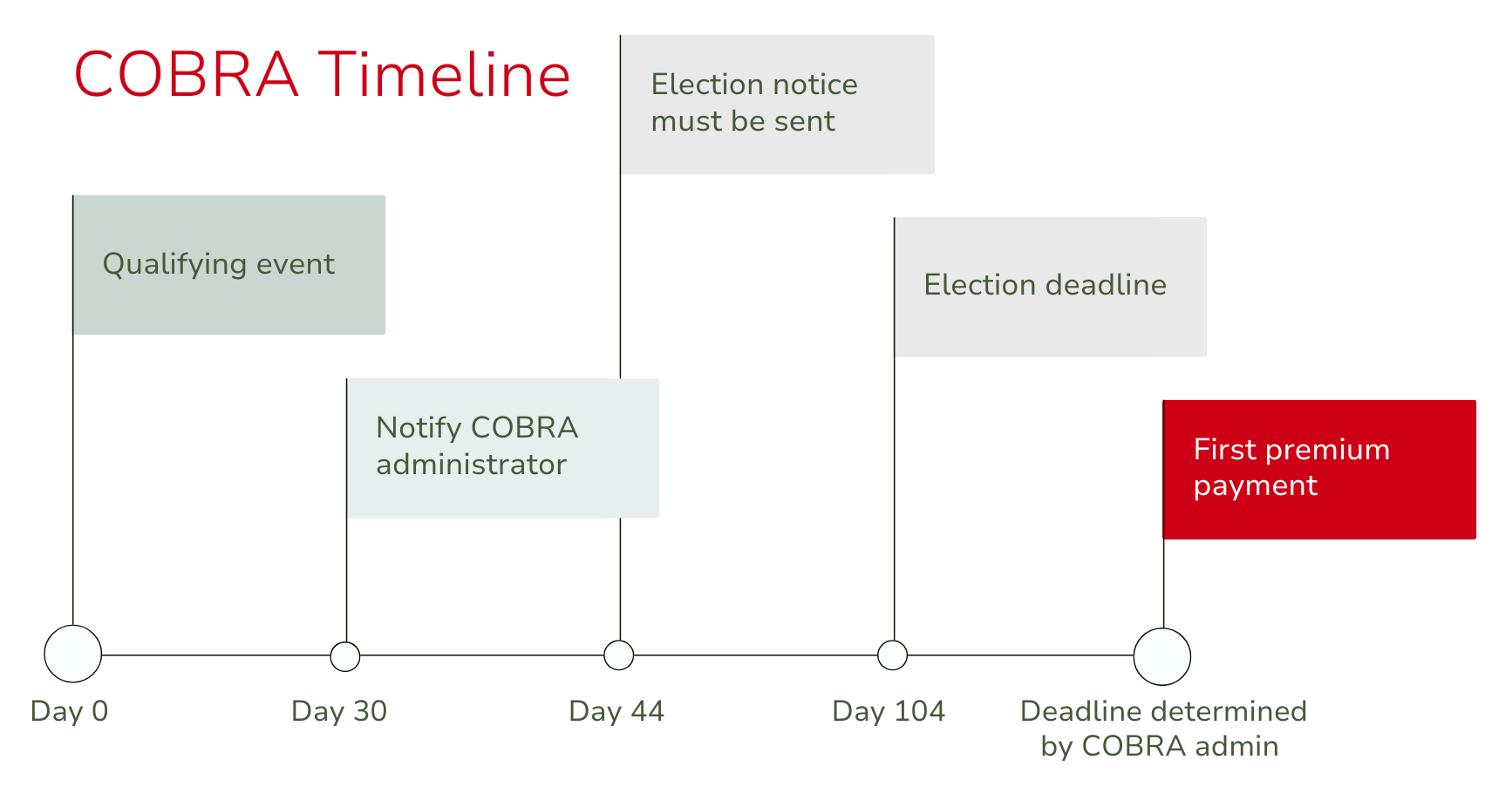

Once a qualifying event occurs, you’ll have 30 days to report it to your COBRA administrator (or handle it internally if you don’t use one). Then, you must ensure the eligible individual receives a COBRA election notice within 14 days. That notice gives them the option to keep their benefits and explains the cost and how long it lasts.

The individual has a 60-day window to decide. If they choose to keep coverage, they’ll have 45 days to pay their first premium. That premium will have to cover the time between losing coverage and electing COBRA, so the first payment is usually for several weeks or even months of coverage.

These timelines are strict, and missing a deadline could mean non-compliance, fines, or unhappy ex-employees. That’s why it’s so important to keep clear records and follow through quickly after someone leaves.

Why COBRA trips companies up

Even though COBRA has been around for decades, it’s still one of those benefits tasks that tends to cause headaches. That’s because it involves multiple steps, firm deadlines, and detailed communication. It’s easy for things to slip through the cracks—especially if there’s no system in place to manage it.

Some of the common issues we see include missing the notification window, using old or incorrect notice templates, forgetting about dependents, or not tracking how long someone’s been on COBRA. These may be honest mistakes, but they can result in real consequences if the IRS or Department of Labor comes knocking.

Do you have to handle COBRA alone?

The short answer is: no. Many companies choose to work with a third-party administrator (TPA) to handle COBRA. That’s where we come in. A TPA can track deadlines, send out the right notices, collect premiums, and answer questions from former employees so your team doesn’t have to.

It’s not just about offloading the work—it’s about protecting your company and making sure you’re doing right by your people, even after they’ve left.

Why COBRA still matters

It might feel like a formality, especially when someone is no longer with your company, but COBRA matters. For many, it’s the difference between staying insured or going without coverage. For employers, it’s not just about wrapping up benefits, it’s about avoiding penalties that can reach $100–$110 per day per violation and reducing legal risk. Even a small oversight can turn into a costly compliance issue, making accurate and timely COBRA administration essential.

Additionally, the way you handle COBRA reflects how your company treats people. If the process is confusing, delayed, or poorly communicated, it can leave a bad impression. But if it’s smooth, timely, and supportive, it shows that your company takes its responsibilities seriously—both legally and personally.

For more information about COBRA, visit dol.gov.

Ready to take COBRA off your plate?

Managing continuing coverage responsibilities may not be the most exciting part of your benefits offering, but it’s one of the most important pieces to get right. It’s detailed, time-sensitive, and easy to mishandle if you’re not careful. That’s why having a reliable processor a dependable partner—or both—makes all the difference.

At Planstin, we manage COBRA for clients of all sizes, and we know how to take the stress off your team. Whether you need full-service administration or just some guidance on how to improve your current process, we’re here to help you stay on track and in compliance.

If you’re unsure about your COBRA setup or you’ve had issues in the past, let’s talk.

We’ll help you make it simple, clear, and most importantly, done right.

Explore

SUGGESTED FOR YOU