What Is an HSA? And How Does It Work?

Whether you’re an individual looking for tax savings, a self-employed professional exploring flexible benefits, or an employer seeking sustainable options for your team, understanding HSAs can unlock major value.

In This Article

If you’ve ever opened a medical bill and felt your stomach drop, you’re not alone. Between rising premiums, confusing networks, and unexpected out-of-pocket costs, managing healthcare can feel at best, overwhelming. And yet, most people don’t realize there’s a smarter way to approach it: one that puts you back in control and helps your money work harder for your health.

What is an HSA?

So, what exactly is an HSA? An HSA is a practical savings account that puts you in control when it comes to managing medical expenses. It allows you to set aside money specifically for healthcare needs and do it in a way that’s tax-efficient and completely yours to manage. Whether you're covering everyday visits or planning ahead for long-term care, an HSA gives you the freedom to choose how and when to use your funds. And this flexibility only expands when you understand who qualifies and how to get started.

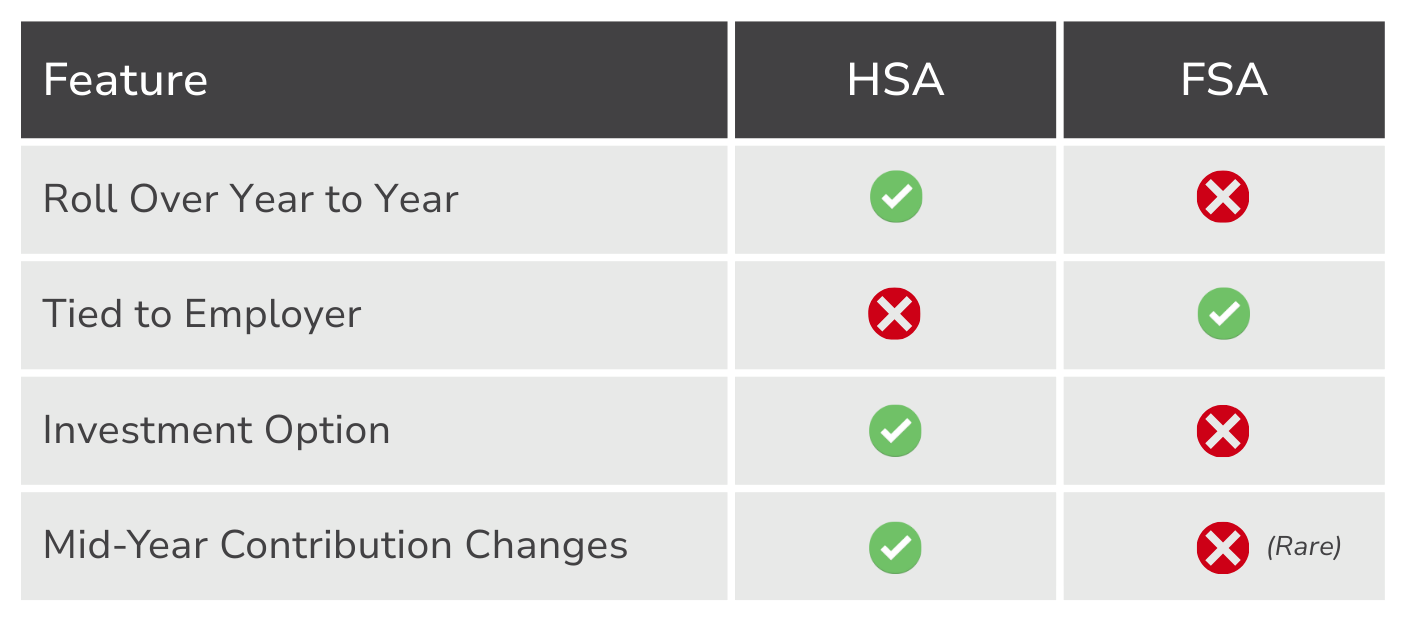

It’s also portable. Your HSA isn’t tied to your job. Whether you switch employers, go freelance, or take time off, your money stays with you, and it never expires.

Who can open an HSA?

To open an HSA, you need to be enrolled in a qualifying high deductible health plan (HDHP). For 2025, that means a plan with at least a $1,650 deductible for individuals or $3,300 for families. You also can’t have other comprehensive health coverage, be enrolled in Medicare, or be claimed as someone else’s dependent.

If you qualify, you can contribute up to $4,300 as an individual or $8,550 as a family in 2025. Those 55 and older can add an extra $1,000. Contributions can come from you, your employer, or both and you can change your contribution amount anytime during the year.

It’s important to understand what makes this account such a smart choice especially when it comes to taxes.

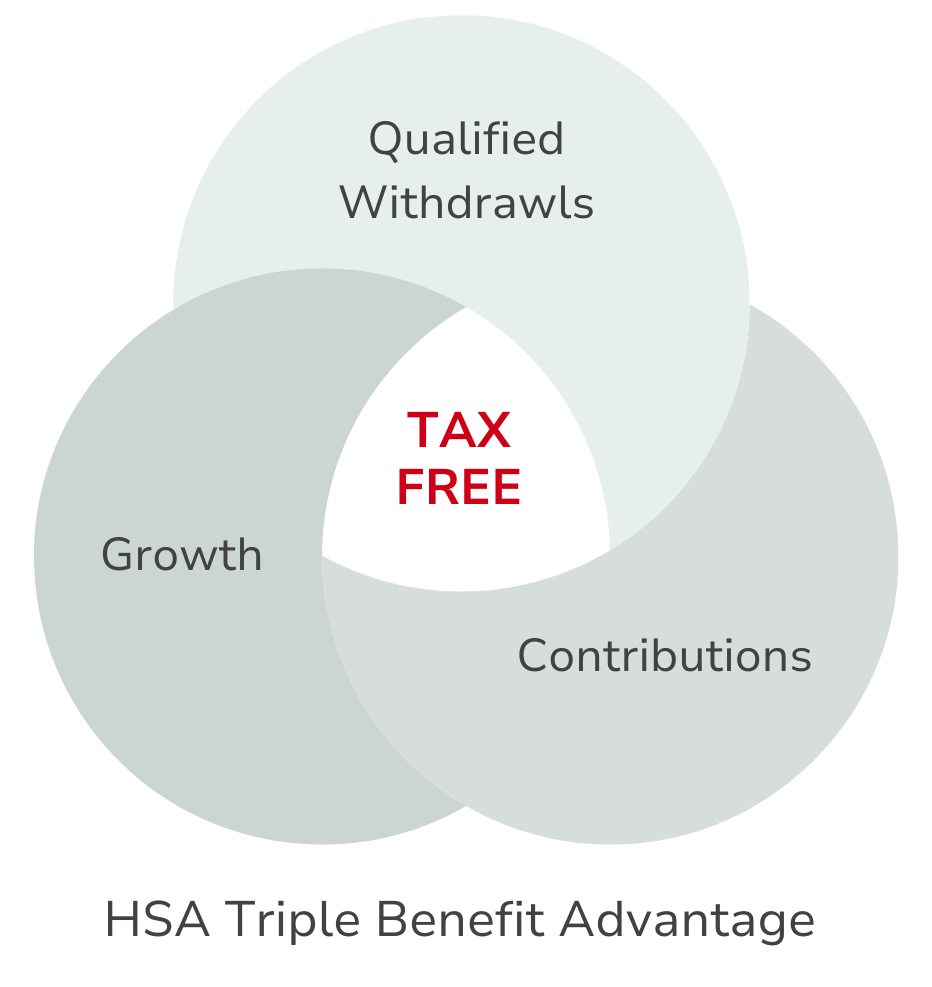

The triple tax advantage

What makes HSAs such a standout? It's the trifecta of tax perks. First, the money you contribute goes in before taxes, reducing your taxable income. Then, any interest or investment earnings in the account grow tax-free. Finally, when you use those funds for qualified medical expenses, you don’t pay a cent in taxes on the withdrawals.

This combination is what makes HSAs more than a savings account. They're one of the most tax-efficient financial tools available.

More than just a savings account

Sure, the tax perks are great but that’s just the beginning. The real power of an HSA is in how it combines short-term flexibility with long-term strategy. You can use it now for medical bills, or let it grow for the future. You can spend it on a dentist appointment this month or invest it for healthcare needs decades from now. It’s both a cushion and a launchpad giving you financial room to breathe today and plan smartly for tomorrow.

What you can use an HSA for

HSAs aren’t just for emergencies. You can use them for everyday medical expenses like doctor visits, prescriptions, dental and vision care, and mental health services. They also cover things like chiropractic care, acupuncture, over-the-counter medications, and menstrual products.

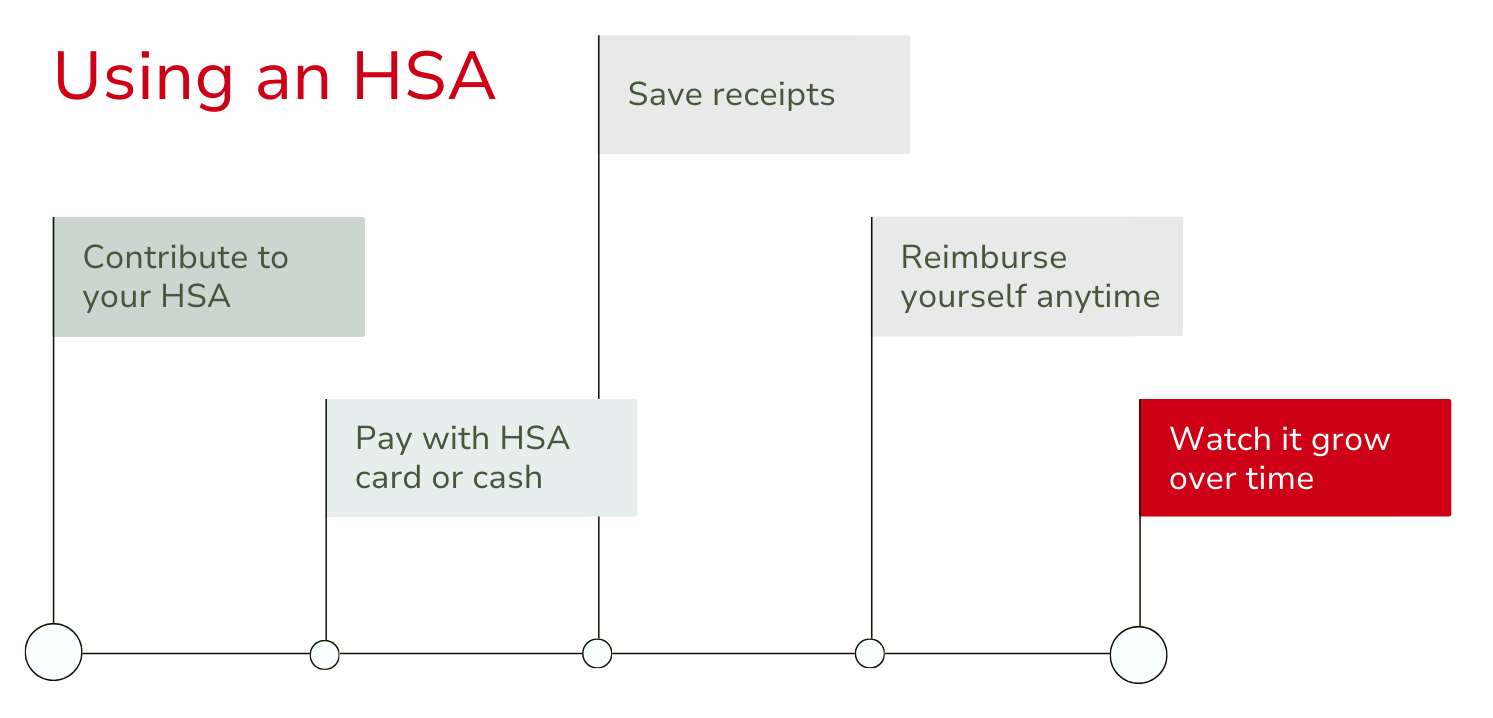

Using Your HSA Day to Day

Using your HSA is simple. You can swipe your HSA debit card at the pharmacy or doctor’s office, or pay out-of-pocket and reimburse yourself later. Just remember to save your receipts especially if you choose to delay reimbursement. There’s no deadline to use the money, and it rolls over every year.

Using Your HSA if You Also Have a HealthShare

If you're part of a HealthShare program, your HSA can be especially helpful. HealthShares often require members to pay an Initial Unshareable Amount (IUA) before any sharing begins—similar to a deductible in traditional insurance. HSA funds can be used to cover that IUA, along with any other eligible medical expenses you’re responsible for under your HealthShare guidelines. This makes the HSA a natural fit for those using nontraditional models of care, offering a tax-efficient way to plan and pay for out-of-pocket costs.

For a full list of eligible expenses, check out IRS Publication 502.

Your HSA as an investment tool

Many HSA providers let you invest your balance in mutual funds or ETFs once you’ve reached a certain threshold. That means your HSA isn’t just a short-term savings tool; rather, it can be a long-term asset.

If you’re able to cover smaller medical costs out of pocket, leaving your HSA funds untouched can allow them to grow significantly over time. And after age 65, you can use the funds for anything—not just healthcare. You’ll pay taxes on non-medical withdrawals, but no penalties.

What If You Use It for Non-Medical Expenses Early?

If you’re under 65 and use your HSA for non-medical expenses, you’ll owe income tax and a 20% penalty. But once you turn 65, that penalty disappears. You’ll still owe taxes on non-qualified withdrawals, but you’ll have the same flexibility as you would with any traditional retirement account.

Avoiding common HSA mistakes

HSAs are easy to operate, swipe a card, pay for medical expenses, track receipts, but their full potential is often miscalculated. Many people use them only for basic spending without realizing how much they can save or grow over time.

Common Mistake #1—Not contributing regularly. Even small, consistent contributions help you build up savings over time and lower your taxable income.

Common Mistake #2—Using your HSA only for immediate spending. While that’s totally valid, you may be missing out on long-term growth. If your provider allows investing, you can let part of your balance grow over time.

Common Mistake #3—Forgetting to name a beneficiary. This can create tax headaches down the line. And skipping receipts? Not worth the risk. You don’t need to submit them to the IRS, but you do need to keep them in case of an audit.

Common Mistake #4—Not knowing what qualifies. Spending HSA funds on non-eligible expenses can result in penalties and taxes. When in doubt, check with your HSA provider or refer to IRS Publication 502.

How does an HSA work for my business?

Since HSAs are such effective healthcare tools, you might want to offer one as part of your company’s benefits package. If your business offers a HDHP, pairing it with an HSA gives employees a powerful way to save money for medical expenses while enjoying tax advantages. You can support your team’s financial well-being without breaking the bank.

You can also choose to contribute to your employees’ HSAs either as a flat amount or through contribution matching. It’s a simple, cost-effective gesture that goes a long way. Your contributions are tax-deductible and exempt from payroll taxes, which benefits your business financially too.

For small and midsize companies especially, HSAs are a thoughtful way to offer meaningful coverage without the steep costs of low-deductible plans. They’re easy to manage, scale as your business grows, and show employees that you're invested in their long-term well-being.

HSA FAQs

Can self-employed people have an HSA? Yes, if you’re on an eligible HDHP.

What happens if I switch jobs? Your HSA goes with you. It’s not tied to your employer.

Can I keep my HSA if I switch to a non-HDHP? You can’t contribute anymore, but you can still use or invest the funds.

How is it different from an FSA? FSAs often have use-it-or-lose-it rules. HSA funds roll over every year.

Can both spouses contribute? Yes. If you have family coverage, you share the annual family contribution limit.

Is an HSA Right for You?

An HSA offers clarity in a space that often feels confusing and overwhelming. It’s one of the few financial tools that balances immediate benefits with long-term potential all in one. With the ability to reduce taxable income, pay for real-life healthcare costs, and invest for the future, it brings practical relief and smart planning together in one account. It’s not flashy but it works.

Ready to take control of your healthcare spending? Start with your HSA.

Give us a call at 888-920-7526 or click the link below to speak with a Benefit Guide.

Explore

SUGGESTED FOR YOU