2026 HSA Contribution Limit Increase

Offering a High-Deductible Health Plan (HDHP) with a Health Savings Account (HSA) remains one of the most effective ways to support your employees’ financial and health goals. With the 2026 updates to HSA contribution limits and HDHP requirements, there are new opportunities to enhance these benefits while maximizing tax advantages.

In This Article

What’s new for 2026

Each year, the IRS updates HSA contribution limits and HDHP requirements. For 2026, both the contribution amounts and the qualifying deductible/out-of-pocket requirements have changed.

Individual Coverage

Contribute up to $4,400 – up $100 from 2025

Minimum deductible of $1,700 – up $50 from 2025

Maximum out-of-pocket limit: $8,500 – up $200 from 2025

Family Coverage

Contribute up to $8,750 – up $200 from 2025

Minimum deductible of $3,400 – up $100 from 2025

Maximum out-of-pocket limit: $17,000 – up $100 from 2025

What these changes mean for your business

Higher contribution limits give employees more room to save tax-free dollars for healthcare and retirement. While employers are not required to increase their contributions, many choose to support their employees’ well-being to align with the new limits.

Employer contributions are also fully tax-deductible, reducing your company’s taxable income while boosting morale and retention. Happy employees foster satisfied customers!

It’s equally important to verify that your HDHP complies with the 2026 minimum deductible and out-of-pocket maximum requirements. Plans that do not meet these requirements do not qualify as HSA-eligible. This means you cannot be enrolled in Medicare, a general purpose healthcare flexible spending account (FSA), or be claimed as a dependent on another person’s tax return.

How OBBBA impacts HSAs

The One Big Beautiful Bill Act (OBBBA) brings broad changes to employee benefits. While HSAs are still governed by IRS rules, the law creates new considerations for both employers and employees that are important to educate on.

HSA Eligibility Still Depends on HDHPs

Even with new flexibility under OBBBA, employees must remain enrolled in a qualified high deductible health plan (HDHP) to contribute to an HSA. If an employee changes their plan to one that doesn’t meet HDHP requirements under OBBBA, they become ineligible.

New Accounts Require Careful Design

The new law encourages additional benefit accounts, such as wellness or supplemental spending programs. However, if these accounts overlap too much with traditional medical coverage (similar to a full health FSA), they could disqualify employees from contributing to HSAs. Employers need to review plan design to confirm compatibility.

Risk of Employee Confusion

With more options available, employees may assume they can combine all accounts without issue. Missteps such as over-contributing or enrolling in conflicting accounts can lead to IRS penalties and unexpected taxes. Clear communication is critical to help employees make the right choices.

Strategic Use of Employer Dollars

For now, HSAs remain fully tax-deductible for employers. Under OBBBA, businesses should decide whether to keep focusing contributions on HSAs or spread funds across multiple new account types. Aligning contributions with long-term employee financial wellness is key.

Why It Matters

Though OBBBA adds complexity, HSAs continue to provide significant advantages on pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. Employers should be aware of the new benefit options introduced under OBBBA, structure plans carefully, and maintain compliance while reinforcing HSAs as a cornerstone of employee financial health.

Communicate with your employees

Employees rely on employers to help them understand how to maximize their benefits. When you share the 2026 updates, it’s crucial to emphasize important details about how they can maximize their HSAs.

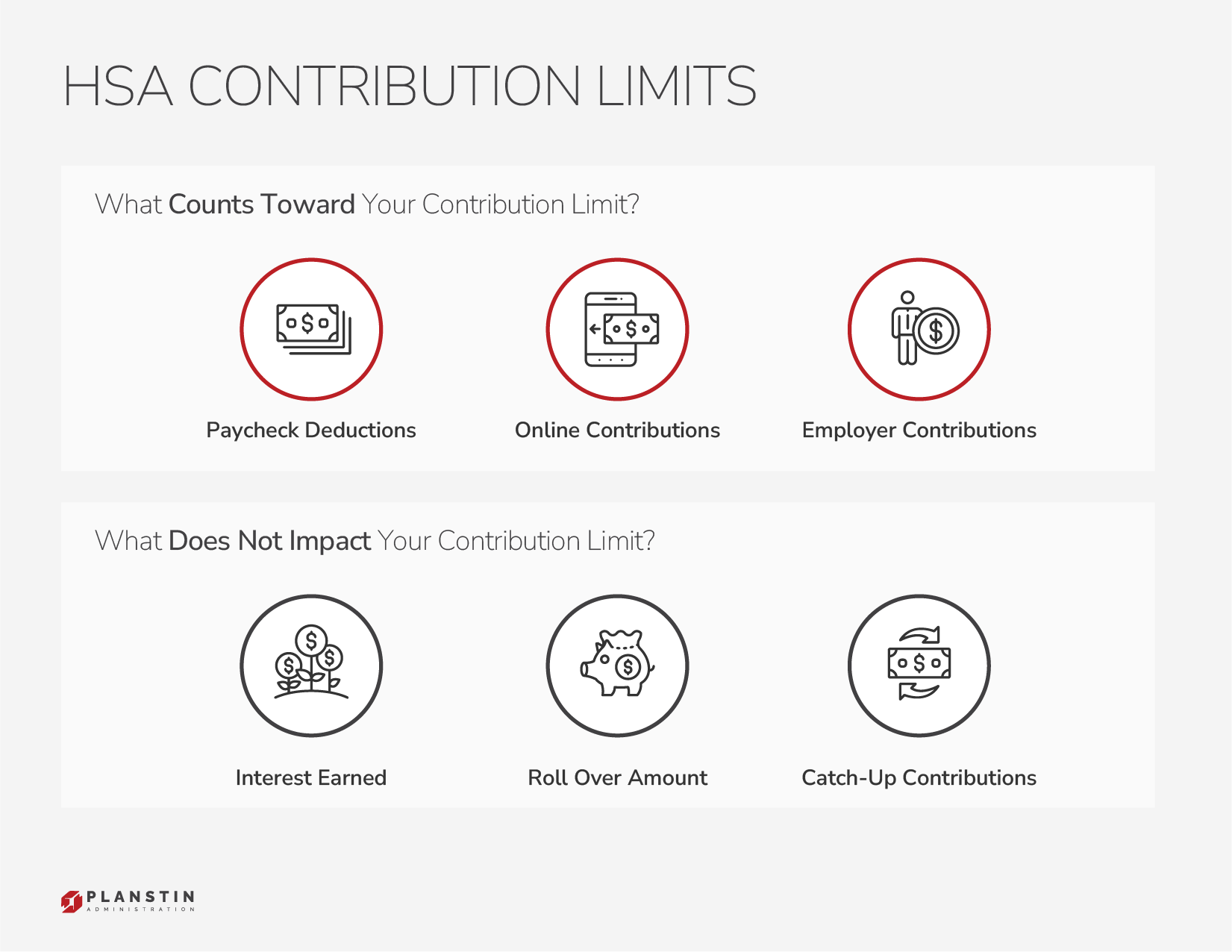

Staying Within the Limit

While the new limits allow for greater savings, contributions that exceed the IRS maximums can trigger penalties and additional taxes. If employees over-contribute, they should contact their HSA provider to fix it as soon as possible.

Maximizing the Benefits

Encourage employees to take advantage of the higher limits by fully funding their HSAs. Contributions will lower taxable income, grow tax-free, and roll over year to year, building a safety net for both healthcare expenses and long-term retirement savings. That’s a triple tax savings advantage and a win-win for employers and employees.

How to Contribute

Remind employees of how they can contribute to their HSA:

- Payroll Deductions: The easiest and most tax-efficient method.

- Online Contributions: Direct transfers from other accounts, though less streamlined for tax purposes.

2025 Contribution Deadline Reminder

Employees still have until April 15, 2026 (the federal tax filing deadline) to make contributions for the 2025 tax year: $4,300 for individuals and $8,550 for families.

Note: For employees 55 and older, an additional $1,000 catch-up contribution is allowed each year. If both spouses are over 55, each can open an individual HSA and make their own catch-up contributions.

The bottom line

Now is the time to support your team by informing them of relevant changes and how they can continue to build their HSAs tax free and benefit from valuable savings each year.

Communicating these changes clearly and early positions your company as a top choice employer in a competitive job market. This is your opportunity to foster a healthier, more financially secure workforce while also benefiting from valuable tax savings.

Have questions?

We are ready to help.

Give us a call at 888-920-7526 or click the link below to speak with a Benefit Guide.

Explore

SUGGESTED FOR YOU