Understanding PCORI Fees: A Guide for Employers

Although the Affordable Care Act mandates PCORI fees, they may not be widely recognized, in fact, this may be the first you are hearing of them. However, all self-funded plan sponsors need to be aware of PCORI fees and their obligation to pay them.

In This Article

The Patient-Centered Outcomes Research Institute is working to raise the bar for healthcare experiences across the industry, work directly funded by mandatory PCORI fees. In this article, we will explore what PCORI fees are, who must pay them, how they are calculated, and their impact on the healthcare industry.

Key Takeaways

- PCORI fees must be paid by any employer who wishes to offer a self-funded health plan.

- PCORI fees are based on the average number of lives covered under the plan.

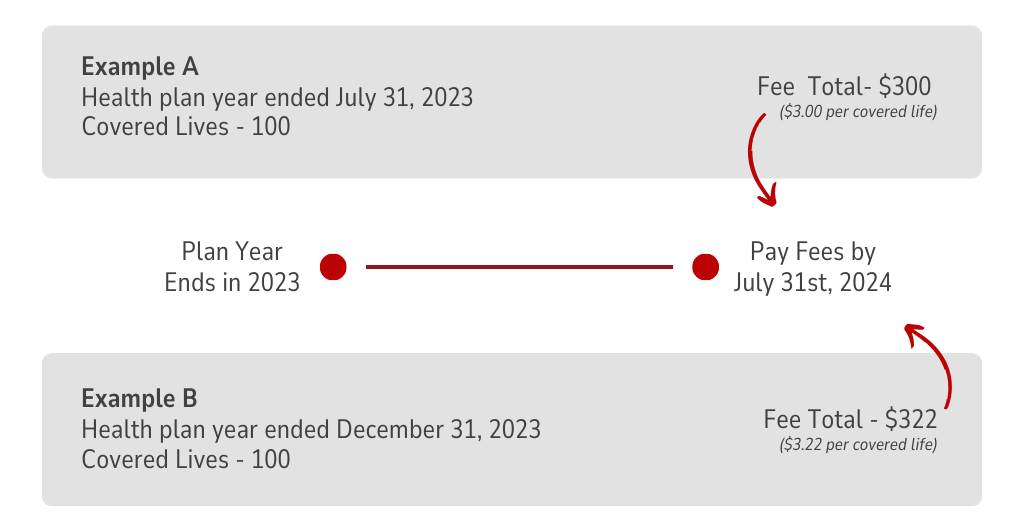

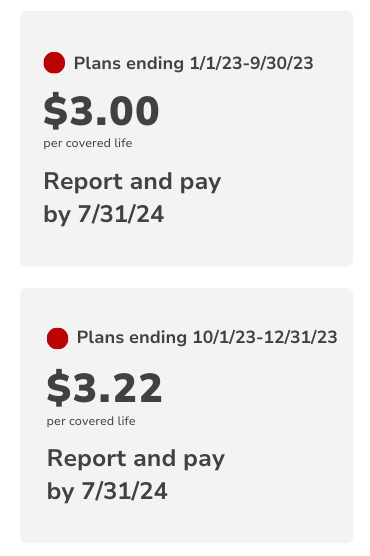

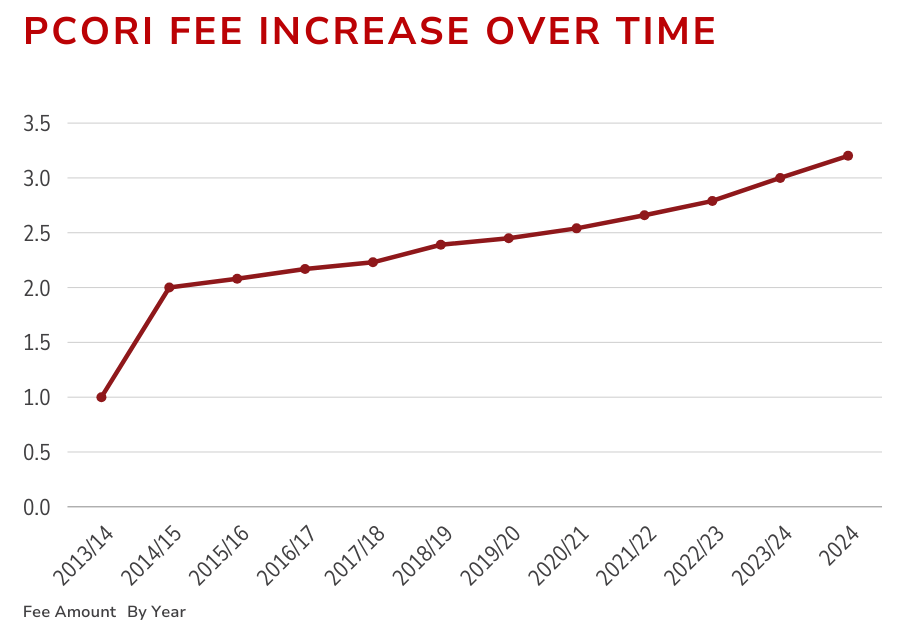

- Current fee is $3.00 per covered life, it is set to increase to $3.22 for plans years ending after September 30, 2023, and before October 1, 2024.

- The fees must be reported using Form 720 (Quarterly Federal Excise Tax Return)

- The fees must be paid by July 31st of the applicable year

- Fees fund the Patient-Centered Outcomes Research Institute, which exists to help improve healthcare decision making.

What are PCORI fees, and who pays them?

In 2019, the Patient-Centered Outcomes Research Trust Fund fee was extended for 10 years. This fee, also known as the Patient-Centered Outcomes Research Institute or PCORI fee, is imposed on health insurance policy issuers and self-funded health plan sponsors every year. The fees support the Patient-Centered Outcomes Research Institute (PCORI), and they are crucial in funding research that helps patients, clinicians, purchasers, and policymakers make better-informed healthcare decisions.

Health Insurance Issuers

Insurers offering specified health insurance policies.

Plan Sponsors

Employers (or other entities) that sponsor self-insured health plans. Health reimbursement arrangements (HRAs) and certain flexible spending arrangements (FSAs) may also be subject to the fee.

How expensive are PCORI Fees?

The individual PCORI fee is fairly reasonable, but depending on the average number of lives your health plan covers, the amount can add up. Currently, the fee is $3.00 or $3.22 per covered life (depending on your plan year end dates). However, since the fee is paid annually, it is not likely to be a tremendous financial burden.

For example, a business whose self-funded health plan ended before October, 1 2023 and covers 100 lives will pay just $300 for the year.

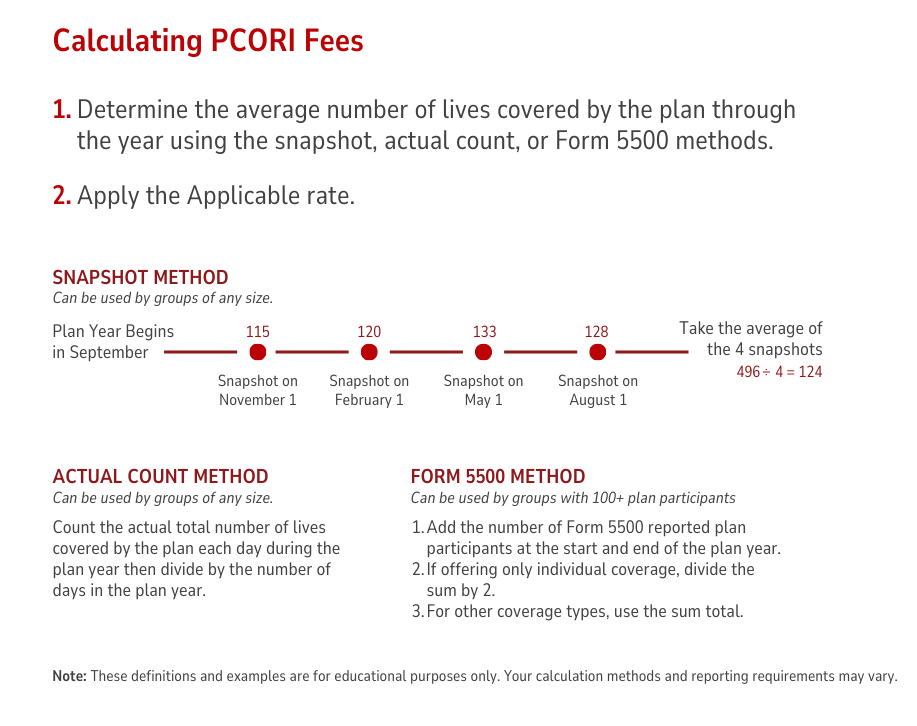

How to calculate your PCORI Fees

The most important part of calculating your fees is determining how many lives your plan covers on average throughout the plan year. Keep in mind, this is total covered lives, and not just the number of covered employees. Once you have that total, you simply multiply the fee amount by the number of covered lives.

When to pay and report PCORI fees

Your PCORI fees must be reported annually. You have until July 31st of the year following the last day of the plan year to pay your fees. For example, if your plan year ended in January 2023, you have all the way until July of 2024 to pay your fees. Unfortunately, if you have a TPA, they cannot report or pay the fees for you. You must report directly to the IRS using Form 720.

For plan years ending in 2024, you will have until July 31, 2025 to report and pay your fees.

Planstin Administration & PCORI Fees

Setting up and managing a robust employee benefits package can be a complex but rewarding endeavor for small business owners. As you go through this journey, it's crucial to keep several key factors in mind to ensure that your benefits strategy aligns with both your business objectives and the needs of your employees.

From selecting the right mix of benefits to understanding the legal and financial implications, each decision plays a vital role in the success of your benefits program.

Additionally, the administrative aspect of efficiently managing these benefits introduces complexities that may initially seem challenging to navigate for many small businesses.

This is where the advantages of partnering with a third-party administrator (TPA) like Planstin comes into play. We can offer valuable assistance in not only simplifying the complexity associated with benefits administration but also in optimizing your benefits package to ensure it's both competitive and compliant.

What do PCORI fees go toward?

Patients and caregivers are at the forefront of the Patient-Centered Outcomes Research Institute’s work. So, the fees paid by insurers directly fund research that improves healthcare delivery and patient outcomes.

The PCORI is committed to feeding “high-integrity, evidence-based” information to the healthcare industry about the effectiveness (or ineffectiveness) of various medical treatments and services. These insights help the greater healthcare community make better decisions and lead to better overall healthcare quality and value.

PCORI: More effective healthcare for all

Annual PCORI fees are an essential part of funding research that enhances healthcare outcomes and decision-making. Understanding who needs to pay these fees, how they are calculated, and their impact on the healthcare system is crucial for insurers and plan sponsors.

By supporting PCORI, these fees advance patient-centered research, and help elevate healthcare for everyone.

Resources:

- For more detailed information, please refer to the IRS guidelines here.

- More Information about calculating the fee can be found here.

- Not sure you’re subject to the fee? View this chart on IRS.gov

If you’re a business owner looking for benefits designed to fit your needs, there are solutions for you.

SUGGESTED FOR YOU