Maximizing Employee Satisfaction with Dental and Vision Benefits

Real benefits that address daily health needs impact focus, loyalty, and long-term success. When your benefits plan covers dental and vision needs, it shows you're thinking beyond what you have to offer and considering your employees' everyday life.

In This Article

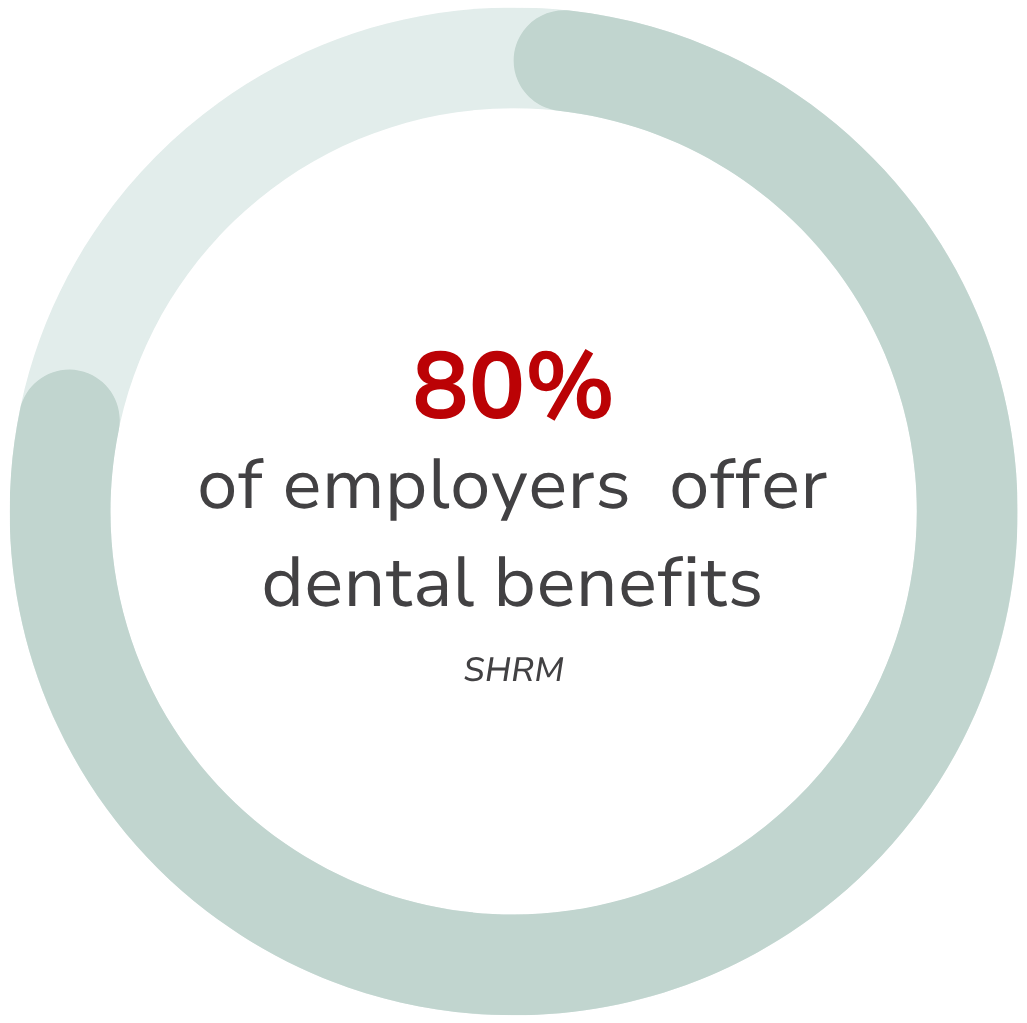

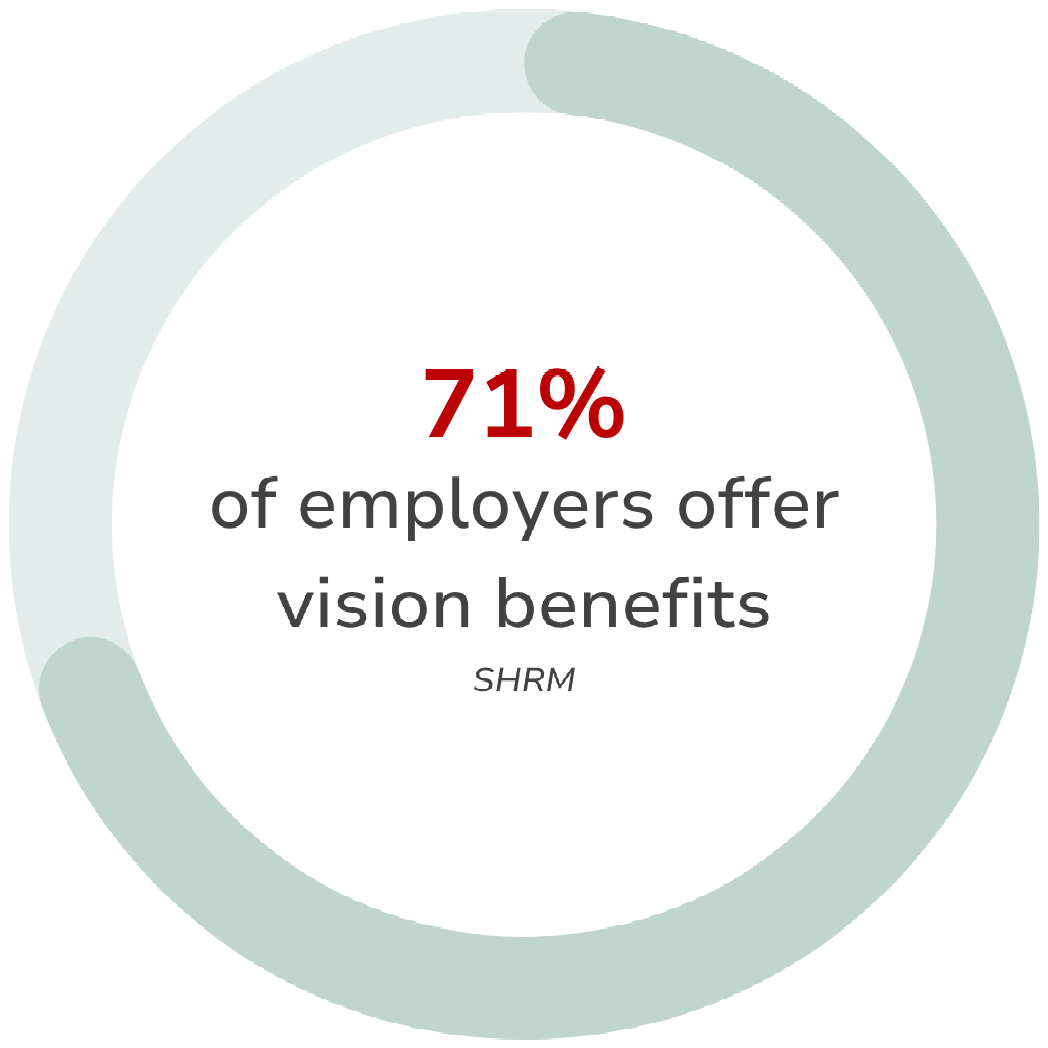

Dental and vision benefits have shifted from being optional perks to expected parts of a comprehensive benefits package. According to SHRM, 80% of employers now offer dental benefits and 71% offer vision coverage, reflecting how these services have moved into standard offerings. Employees increasingly rank dental and vision care among the top non-medical benefits that influence their satisfaction and loyalty. Including these benefits is a relatively low-cost way for employers to strengthen workforce stability, reduce preventable absences, and stay competitive in today’s labor market.

Why vision and dental benefits matter

Major medical coverage addresses serious health conditions, but everyday health needs often start elsewhere. Preventive services like dental cleanings, cavity checks, eye exams, and updated vision prescriptions make a noticeable difference in an employee’s day-to-day comfort and ability to work effectively.

Left untreated, minor issues like toothaches or blurred vision can escalate, leading to more serious health concerns, emergency visits, or extended time away from work. Even without major incidents, discomfort caused by dental or vision issues can lead to loss of focus, lower productivity, and increased workplace errors.

Dental and vision benefits allow employees to handle these issues proactively, improving both individual health outcomes and the company’s bottom line. Preventive care also tends to be more affordable for both employers and employees compared to reactive or emergency care.

When employees can easily access routine services, it reduces the need for urgent interventions and the associated costs.

Benefits that support retention and productivity

Access to dental and vision care has become an important benchmark for how employees evaluate the strength of a benefits package. These services address everyday health needs that directly impact an employee’s ability to work effectively.

Offering dental and vision benefits shows that a company is focused on maintaining long-term employee health, not just providing coverage for emergencies. As more employers make these services standard, businesses that overlook them risk falling behind in employee expectations—and in attracting and retaining top talent.

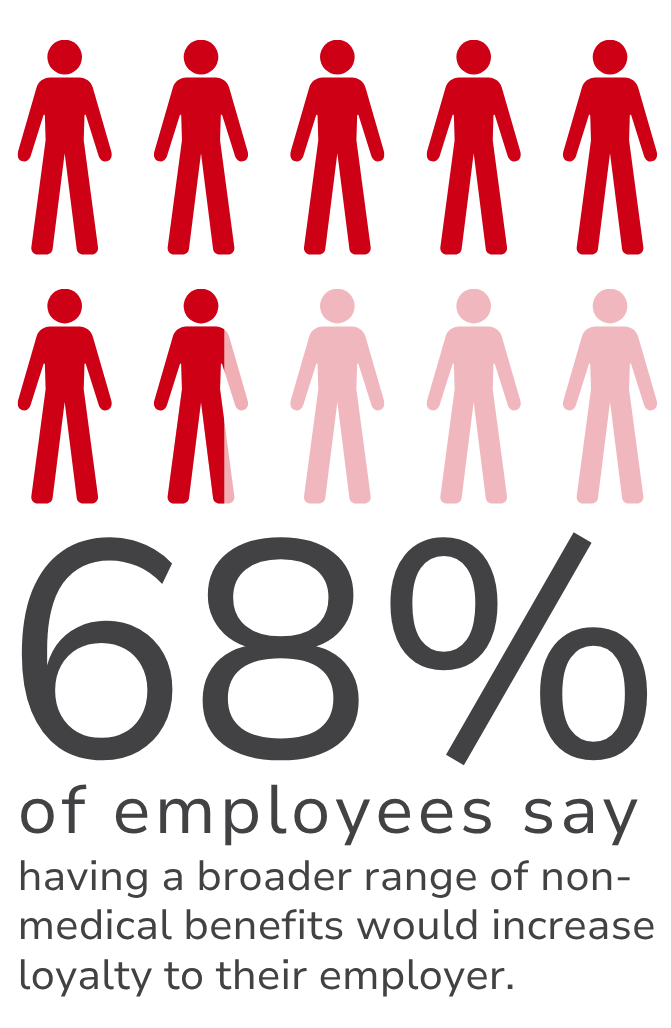

A 2023 survey by MetLife found that 68% of employees say having a broader range of non-medical benefits, including dental and vision, would increase their loyalty to their employer. In industries facing worker shortages or high turnover, offering a benefits package that includes these options can create a meaningful competitive advantage.

When employees feel that their everyday needs are supported, they are more likely to stay with a company long-term. This, in turn, reduces hiring and training costs while strengthening institutional knowledge and team cohesion.

Additionally, employees who can easily access vision correction and dental care tend to have better health outcomes overall, resulting in fewer absences, fewer short-term disabilities, and higher on-the-job performance.

Flexible options for small businesses

One common misconception is that only large companies can afford to offer comprehensive benefits packages. In reality, flexible dental and vision plans make it possible for businesses of all sizes to provide meaningful coverage without overwhelming their budgets.

Another smart strategy is pairing benefits with a Health Savings Account (HSA). HSAs allow employees to save pre-tax dollars for eligible expenses, including dental and vision care. Employers benefit too, with reduced payroll taxes and the ability to offer a valuable, flexible tool that empowers employees to manage their healthcare spending more effectively.

Together, flexible benefit structures and HSAs offer small businesses a way to provide a high-value, cost-controlled benefits experience.

Why dental and vision benefits are a win-win for employers

One of the reasons dental and vision coverage has gained traction is that it offers a high return on a relatively low investment. Compared to major medical insurance, dental and vision plans are significantly less expensive to provide. Yet they offer benefits that virtually every employee can access and appreciate.

While not every employee will experience a major medical event each year, nearly all will use their dental or vision benefits. Cleanings, exams, cavity treatments, glasses, and contact lenses are everyday needs. Utilization rates for dental and vision plans often exceed those for major medical plans, particularly among younger and healthier employees.

By offering affordable access to preventive care, employers help reduce the risk of more serious—and more costly—health issues over time. Routine dental exams can catch early signs of systemic conditions such as diabetes or heart disease, while regular vision screenings can detect early health changes that might otherwise go unnoticed.

What employees want in dental & vision plans

When evaluating dental and vision benefits, employees typically focus on three main factors.

1. Affordability

Lower out-of-pocket costs for services like routine cleanings, exams, glasses, and contacts. Employees want to know that using their benefits will not cause financial stress.

2. Provider Choice

Access to a broad network or the freedom to visit preferred providers ranks highly when employees consider their satisfaction with a plan.

3. Simplicity

Clear communication about what is covered, transparent pricing, and an easy-to-understand processes. Complicated claims, fine print, or surprise costs can quickly erode confidence in the overall benefits package.

By focusing on these factors when designing and communicating benefits, employers can better meet employee expectations and improve overall satisfaction with their offerings.

A smarter approach to benefits

Dental and vision benefits are sometimes overlooked in strategic planning, but they play a critical role in employee wellness, satisfaction, and business success. Offering access to preventive services, supporting health maintenance, and giving employees flexible options for managing healthcare costs shows a proactive, modern approach to workforce management.

The return on investment is clear: healthier employees, lower turnover, stronger recruitment, and fewer productivity losses due to untreated health issues.

Planstin works with businesses of all sizes to design smart, affordable benefits strategies including dental and vision coverage options that strengthen teams and support long-term growth.

Looking to explore dental and vision options for your team? Give us a call at 888-920-7526 or click the link below to speak with a Benefit Guide.

Explore

SUGGESTED FOR YOU