ACA 2026 Update: Reporting and Penalty Adjustments

The compliance landscape for employers continues to evolve in 2026, with updates affecting Employer Shared Responsibility Payments (ESRP) under the Affordable Care Act (ACA) and IRS reporting penalties.

In This Article

After a brief and unexpected dip in 2025, the IRS is once again raising the Employer Shared Responsibility Payment (ESRP) penalties in 2026. Since the Affordable Care Act (ACA) first took effect, these penalties—outlined under Section 4980H—have generally climbed each year to account for inflation. The temporary reduction in 2025 caught many employers' attention, but it appears to have been a one-year anomaly.

For 2026, both the "A" and "B" penalty amounts are increasing, reversing last year's decline and reinforcing the IRS's ongoing commitment to ACA compliance enforcement. Employers, especially those close to the Applicable Large Employer (ALE) threshold, should take note of these new figures and ensure their health coverage offering remains compliant to avoid financial consequences.

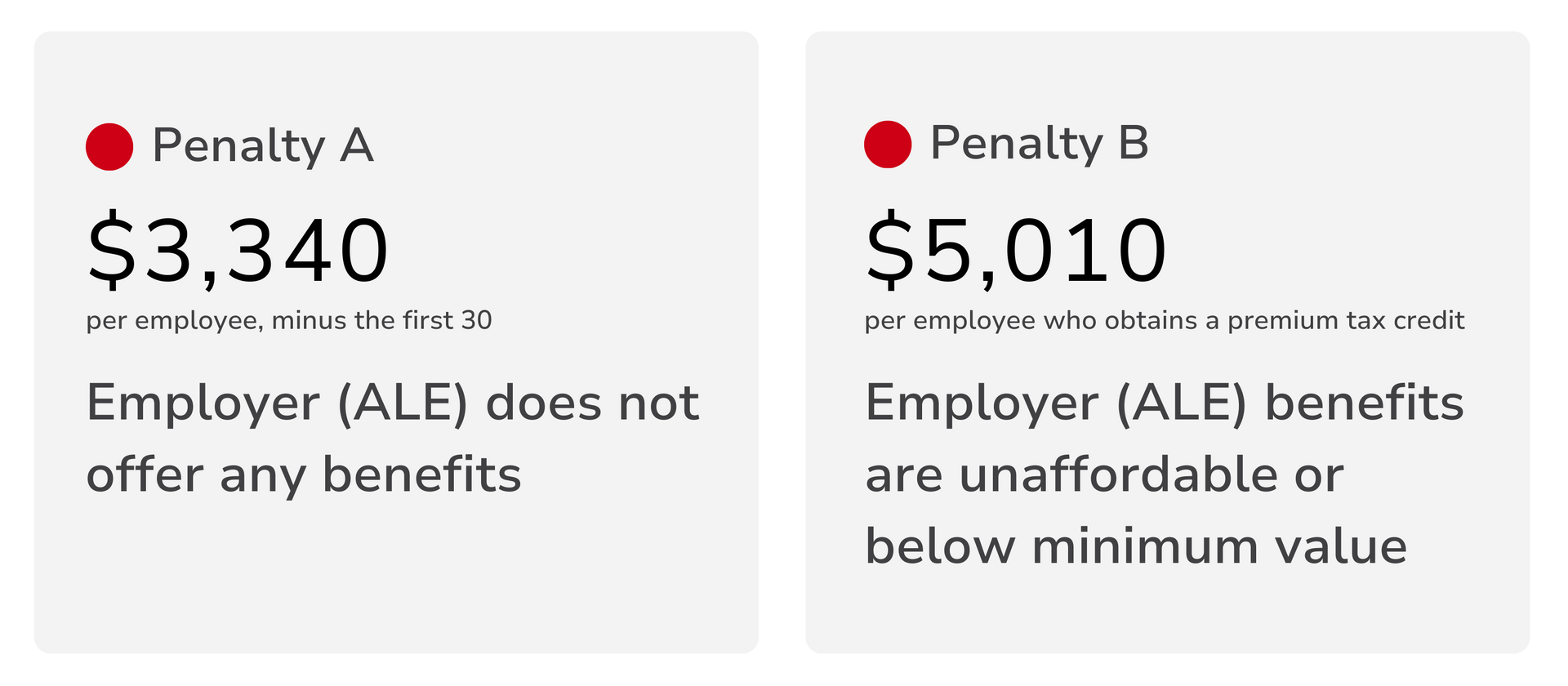

A quick ESRP (Section 4980H) penalty refresher

If your company has 50 or more full-time (or full-time equivalent) employees, the ACA requires you to offer affordable, minimum-value health coverage to your full-time employees and their dependents. If you don’t, there are two potential penalties, of which you will pay one or the other.

Penalty A: No coverage offered

This penalty is triggered if you offer nothing, or don’t offer coverage to at least 95% of your full-time employees.

Penalty B: Insufficient coverage offered

This penalty is triggered if one of your full-time employees gets a premium tax credit because the coverage you’ve offered is either unaffordable or doesn’t meet the ACA’s minimum value standards.

2026 ACA penalty updates

Employer Shared Responsibility

As stated earlier, the Section 4980H penalty amounts are going up this year. If you are an ALE, this shift represents an opportunity to reassess your healthcare strategy and make sure you’re complying with the law—without unnecessary penalties eating at your bottom line.

- 4980H-A - $3,340 per full-time employee (up from $2,900)

- 4980H-B - $5,010 per full-time employee receiving a tax credit (up from $4,350)

Reporting

Just like the 4980H penalties this tax year, some of the reporting penalties under sections 6055 and 6056 have increased.

- Failure to report -> $340 per return (up $10)

- Corrections to a filed report

- made within 30 days -> $60

- made after 30 days -> $140 per return (up $10)

- Intentional disregard -> $680 or 10% of the total reported amount (up $20)

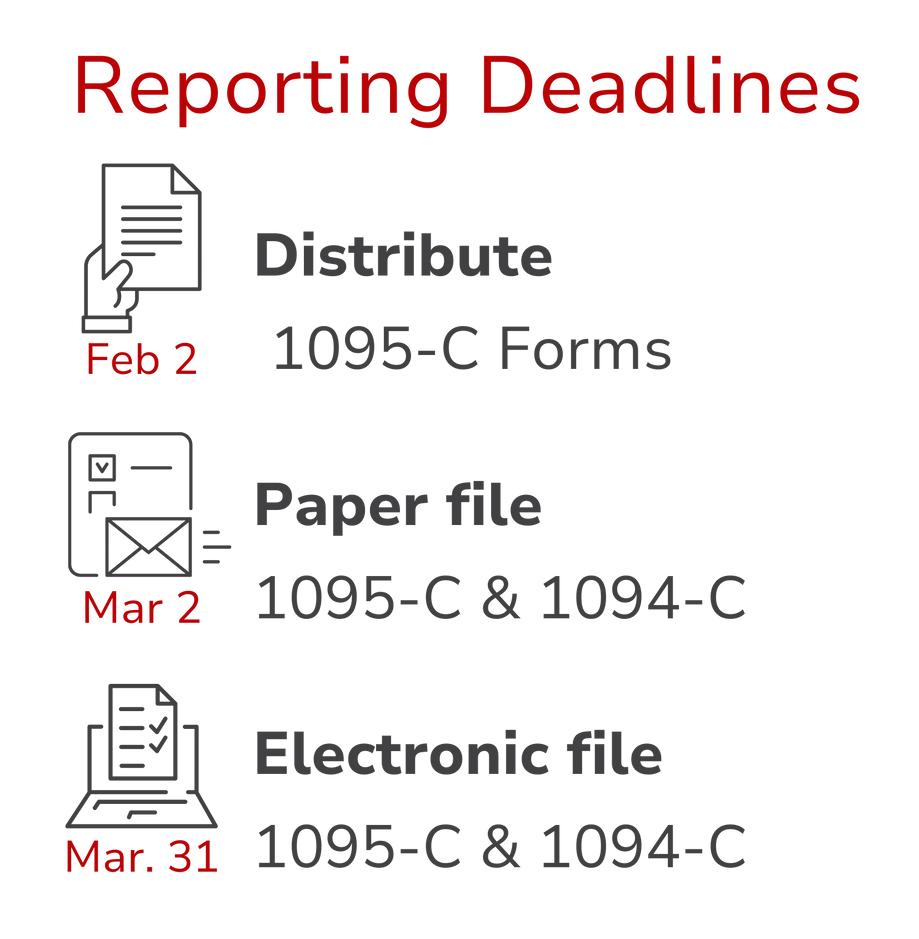

2026 Reporting Deadlines

The deadline to provide individual, 1095-C statements to your employees is February 2, 2026.

The deadline to file forms 1095 and 1094 with the IRS is March 2 by mail, or March 31 for electronic submission.

Impact on you

Both the employer shared responsibility penalties and penalties for intentional disregard are going up. For now, it’s critical for you to understand if you are an ALE with a responsibility to report. If you are, you should review your health plan offering and make sure you are meeting the ACAs minimum requirements. This includes evaluating your health plan’s affordability and the extent of plan coverage. Additionally, you will want to verify that you have indeed made offers of coverage to all eligible employees.

- Verify your ALE status

- Review your plan offering

- Confirm you’ve made offers of coverage

- Report to the IRS

Planstin can help you navigate these changes whether that means auditing compliance, optimizing benefit design, or implementing cost-effective health plans so your organization stays compliant and competitive. We’re here to help you handle the finer points of compliance and navigate the benefits maze without the stress.

For detailed information from the IRS about penalties and deadlines, read this.

To learn more about your responsibilities as an ALE,

read this.

Want to make sure your business is protected from penalties in 2026? Let’s talk.

Give us a call at 888-920-7526 or click the link below to speak with a Benefit Guide.

Explore

SUGGESTED FOR YOU