ACA Q&A: What Every ALE Needs to Know

If you're an Applicable Large Employer (ALE), navigating the Affordable Care Act (ACA) can feel like decoding a foreign language. With evolving rules, complex forms, and hefty penalties, it's easy to feel overwhelmed. But don't worry, we're here to break it down in plain English.

You don’t need a law degree or an in-house team to understand ACA compliance implications for your business. This guide breaks down the ACA from an ALE’s perspective (and defines ALE just in case this is your first run-in with that abbreviation). We’ll walk you through the essentials, define key terms, and explain the penalties in plain English. Whether you’re reviewing your strategy for the year or just figuring out if you qualify as an ALE, this is a great place to start.

What is the ACA?

The Affordable Care Act is a federal law that was enacted in 2010 to make health insurance more accessible and affordable. For employers, it introduced new responsibilities, especially for those classified as ALEs.

What is an ALE?

In This Article

An Applicable Large Employer is a business that had an average of at least 50 full-time employees (including full-time equivalents) during the previous calendar year. If you're an ALE, you're subject to specific ACA requirements, including offering health coverage to your full-time employees and reporting to the IRS.

Note: You don’t need 50 FTEs at all times to be an ALE. But if you have 50 FTEs on average throughout the year the IRS will consider you an ALE.

What is the employer mandate?

The ACA's Employer Mandate requires ALEs to offer health insurance that is both affordable and provides minimum value to at least 95% of their full-time employees and their dependents. Failing to meet this requirement can result in significant penalties.

What are ALE reporting requirements?

ALEs must file IRS Forms 1094-C and 1095-C annually. Form 1094-C is like a cover page that summarizes the employer's information, while Form 1095-C provides details about the health coverage offered to each full-time employee. These forms help the IRS determine compliance with the ACA Employer Mandate.

What are essential health benefits?

Essential Health Benefits (EHBs) are a set of 10 categories of services that health insurance plans must cover under the ACA. These include:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services

- Laboratory services

- Preventive and wellness services

- Pediatric services

While large group plans aren't required to cover all EHBs, understanding them helps in designing comprehensive coverage.

What is minimum essential coverage?

Minimum Essential Coverage (MEC) refers to health insurance that meets the ACA's basic requirements. This includes most employer-sponsored plans, individual market plans, Medicare, Medicaid, and other government-sponsored programs. Offering MEC is the first step in ACA compliance for ALEs.

What is qualifying healthcare coverage?

Qualifying healthcare coverage is another term for Minimum Essential Coverage. It's the type of coverage that satisfies the ACA's individual mandate, ensuring individuals have access to basic healthcare services.

What is the minimum value standard?

The Minimum Value Standard requires that a health plan covers at least 60% of the total allowed costs of benefits. This means the plan should pay for 60% of covered healthcare expenses, with employees covering the remaining 40% through deductibles, copayments, and coinsurance.

In addition to this standard, plans that are ACA compliant must provide “substantial coverage” for inpatient and physician services.

What is a premium tax credit?

A Premium Tax Credit is a subsidy that helps individuals and families afford health insurance purchased through the Health Insurance Marketplace. If an ALE fails to offer affordable, minimum value coverage, and an employee receives a Premium Tax Credit, the employer may face penalties.

What penalties might an ALE face for non-compliance with ACA regulations?

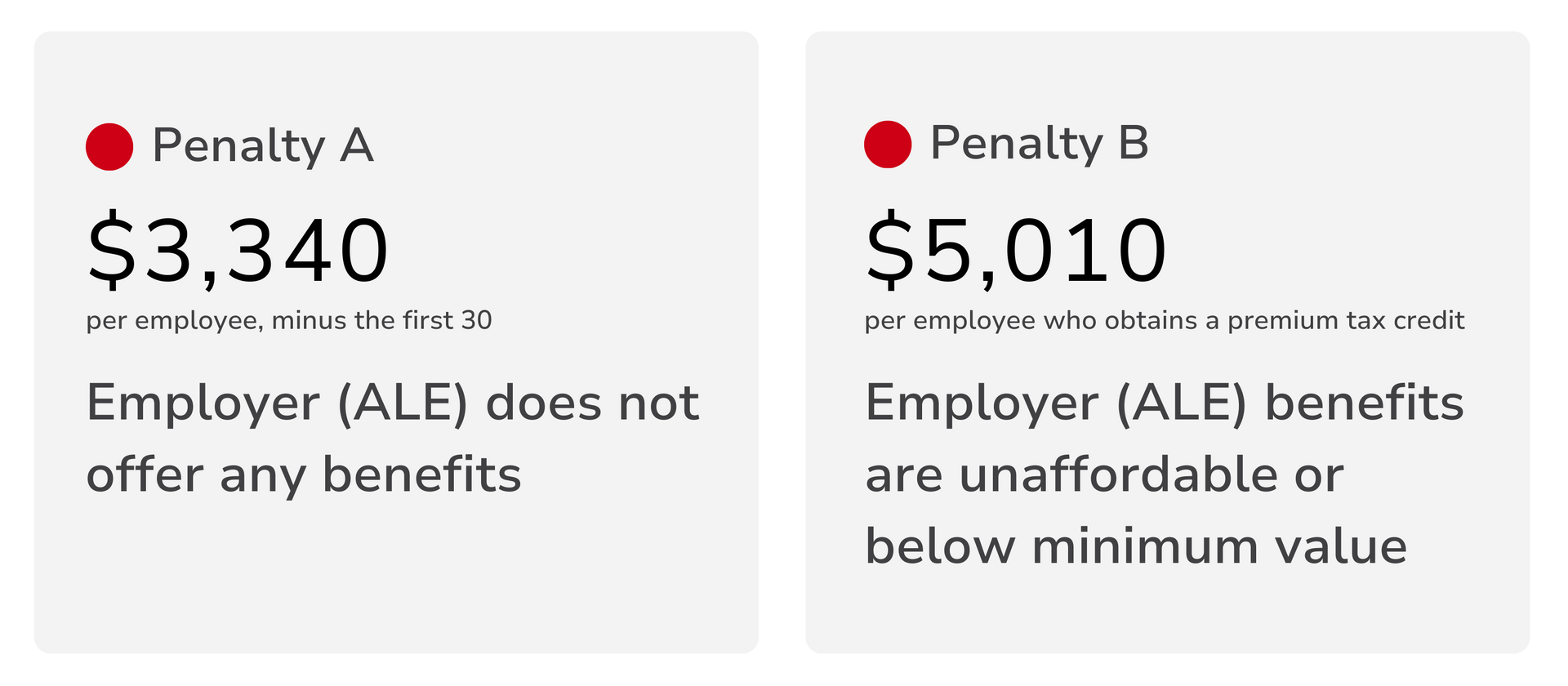

There are two main tax penalties an ALE may be at risk for under the ACA employer mandate.

4980H(a) Penalty

If an ALE fails to offer MEC to at least 95% of full-time employees and their dependents, the employer faces a penalty. For 2026, this penalty is $3,340 per full-time employee, excluding the first 30 employees.

4980H(b) Penalty

If an ALE offers coverage, but it's either unaffordable or doesn't provide minimum value, and at least one full-time employee receives a Premium Tax Credit, the employer faces a penalty. For 2025, this penalty is $5,010 per affected employee.

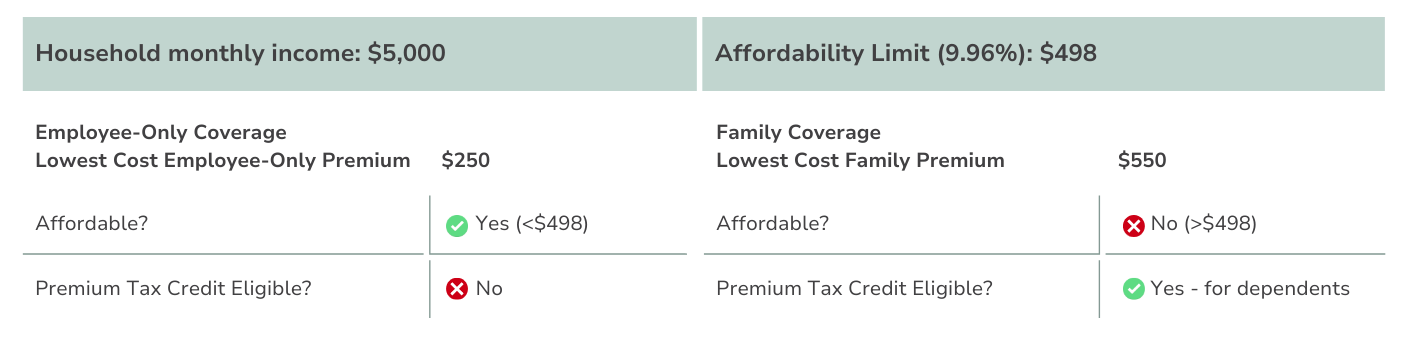

What are ACA affordability standards?

For 2026, coverage is considered affordable if the employee's share of the premium for self-only coverage does not exceed 9.96% of their household income.

Since employers often don't know employees' household incomes, the IRS provides three safe harbors to determine affordability.

(See What are Safe Harbors? below)

Affordable Coverage Example (2026)

What are safe harbors?

Safe harbors are methods provided by the IRS to help employers determine if the coverage they offer is affordable. Using these safe harbors protects employers from penalties, even if the coverage turns out to be unaffordable based on an employee's actual household income.

- W-2 Safe Harbor: Based on the employee's W-2 wages.

- Rate of Pay Safe Harbor: Based on the employee's hourly rate multiplied by 130 hours per month.

- Federal Poverty Line Safe Harbor: Based on the federal poverty level for a single individual.

Do ALEs have to offer dependent coverage?

Yes, ALEs must offer coverage to full-time employees and their dependents up to age 26. This includes any child who has been legally adopted. While ALEs are required to offer coverage to dependent children, spouses are not considered dependents under the ACA's rules for this mandate

Has the One Big Beautiful Bill Act (OBBBA) changed ACA rules for ALEs?

No. While the OBBBA introduced sweeping reforms to Medicaid, Medicare, ACA premium tax credits, and work requirements, it doesn't directly alter the ACA's Employer Mandate or ALE definitions. These remain governed by existing ACA regulations.

Do ACA regulations ever change?

Yes, ACA regulations are subject to change. For instance, in 2026, the affordability percentage increased from 9.02% to 9.96%. Staying informed about these changes is crucial for compliance.

Final thoughts

ACA compliance is one of those things that can either feel like a looming liability or a manageable task. The difference? Having the right tools, the right strategy, and the right support.

At Planstin, we know benefits can feel like a burden. But we believe they shouldn’t. We help employers cut through red tape, simplify compliance, and deliver coverage that works. Whether you are trying to avoid penalties, understand reporting rules, or build a smarter health plan, we’re here to make it easier. No jargon. No guesswork. Just smart benefits that keep your business protected and your people supported.

Tools & Resources

- The IRS ACA Information Center

- Planstin’s Quick ALE Calculator

- The Federal Poverty Line Guidelines Chart

Ready to take control of your benefits? Talk to a Benefit Guide today—we'll walk you through it.

Explore

SUGGESTED FOR YOU