Navigating Rising Healthcare Costs: Strategies for Employers

The rising cost of healthcare in the US is a pressing concern, with family insurance premiums approaching $24,000 this year, a 7% increase from the previous year according to a KFF survey. During open enrollment season, employers in a competitive job market face the challenge of offering appealing benefits while managing these escalating costs. This blog explores effective strategies to tackle these challenges.

Understanding the drivers of high healthcare costs and what you can do about them

While some factors driving healthcare costs are beyond employers’ control, there are areas where businesses can exert influence. We'll focus on three controllable factors: the health of employees, the lack of choice in healthcare plans, and inflated prices from healthcare providers.

Factor 1: Unhealthy Employees

Chronic illnesses and mental health conditions, often exacerbated by obesity and delayed medical care, contribute significantly to the $3.7 trillion annual healthcare expenditure in the US, according to the Centers for Disease Control and Prevention.

Strategies for improving employee health

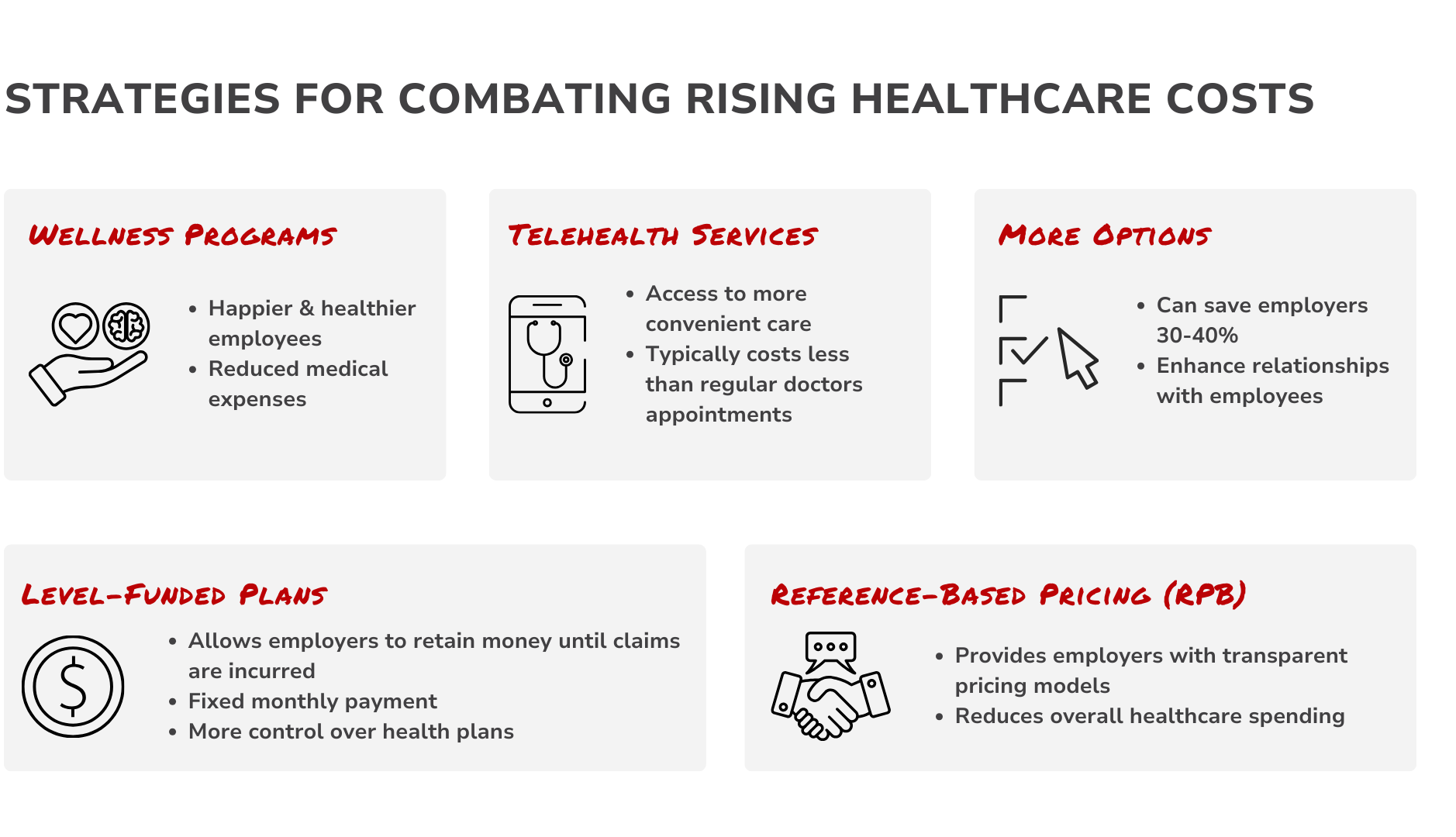

By introducing wellness programs as part of your employee benefits package, your employees will be happier and healthier — leading to reduced medical expenses, and potentially lower future medical premiums.

Additionally, incorporating telehealth services into your benefits can help your employees seek care more often due to the conveniency and savings virtual appointments provide.

Factor 2: Limited Choice in Healthcare Plans

About 159 million American workers have employer-chosen health insurance, often selected based on factors like ACA compliance and budget constraints, leaving employees with little say in their healthcare options.

Strategy for providing more options

Providing employees with options, such as a traditional health plan paired with a non-traditional product like a Minimum Essential Coverage (MEC) plan and a HealthShare membership, can save companies about 30-40% while maintaining ACA compliance. Giving your employees choices will also enhance how they feel about you as an employer.

Factor 3: Pricing Power of Hospitals and Providers

The trend of mergers and partnerships in the healthcare sector often leads to near-monopolies, enabling providers to demand higher prices.

Strategies for lowering healthcare costs

Reference-based pricing (RBP) plans allow employers to negotiate directly with healthcare providers, potentially achieving significant discounts and reducing out-of-pocket costs for your employees.

Employers can also opt for level-funded plans, a type of self-funded plan with a fixed monthly contribution covering administration, claims payments, and stop-loss insurance. Understanding the thresholds for stop-loss coverage is crucial to avoid surprise charges.

Don’t let high costs stop you from offering benefits

Rising healthcare costs may seem daunting, but by adopting these strategies, you can offer employees meaningful choices and manage expenses effectively. At Planstin, the right benefit guide can assist in setting up these options, ensuring both employer satisfaction and employee welfare.

Let us help you figure out the right strategy for your business today!

Legal disclaimer: This is not legal advice. For questions regarding your specific situation, please consult an attorney.

Explore

SUGGESTED FOR YOU