Small Business Health Plans: 3 Alternatives to Traditional Insurance

We consistently hear from many small business owners about the challenges they face in trying to offer benefits. Fortunately, there are alternatives to traditional insurance that are creating more positive outcomes for small businesses.

In This Article

As a small business owner, you have a lot on your plate—tracking cash flow, purchasing supplies, taking care of customers, and much more. And most importantly, you’re trying to take care of the people who help make your business come alive, your employees.

If you’ve thought about offering your employees health benefits but decided not to because of costs associated with small business health plans, the amount of time it takes to manage benefits, and the complex regulations you must follow, you’re not alone. Nearly 50% of businesses in the U.S. still don’t offer benefits.

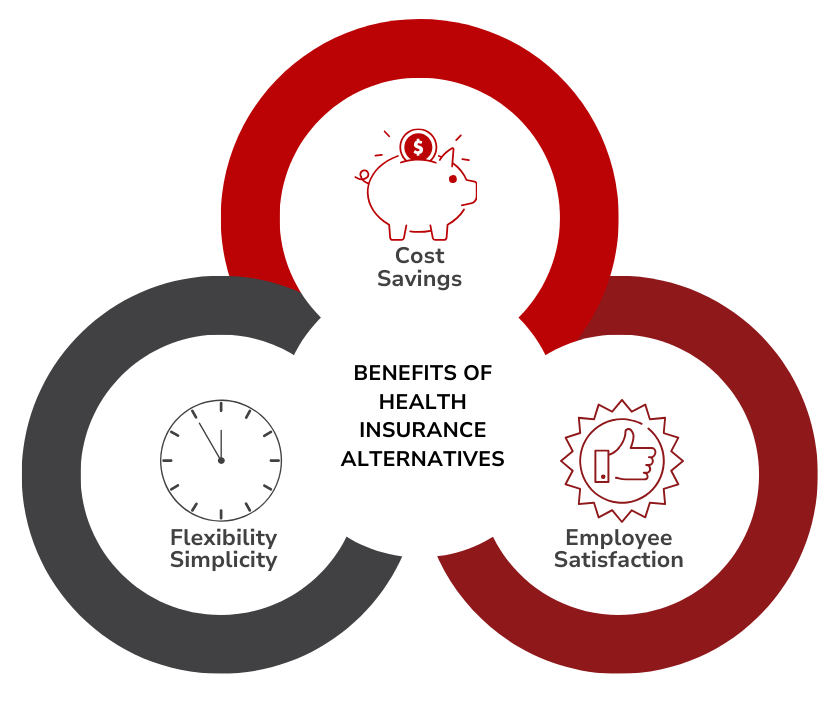

Why small businesses should consider alternatives to traditional insurance

It’s essential to understand why exploring different healthcare options, like the ones mentioned later in this article, can be beneficial for your business.

Cost Savings

Traditional health insurance premiums are continuing to rise each year, making it difficult for small businesses to afford the coverage they need for their employees.

Average annual premiums increased 7% in 2023, with $8,435 for single coverage and $23,938 for family coverage. In the same 2023 report from KFF, the growth in the average premium for family coverage (47%) has far outpaced the rate of inflation (30%) in the last 10 years.

Simplicity and Flexibility

The time you spend managing benefits varies with the number of employees. Typical tasks for managing employee benefits include coordinating open enrollment and new hire enrollments, handling payments to insurance carriers, helping employees with claims issues, and filing reports with government agencies.

Many alternative options come with less administrative complexity and more flexible plans, allowing you to tailor healthcare solutions to your employees' needs.

Employee Satisfaction

Employees’ satisfaction with their benefits fell to 61% in 2023, according to MetLife’s 2023 Employee Satisfaction Survey. The well-being and care of employees is one of the top reasons employers are starting to invest more in employee benefits. By offering more than traditional health plan options, you’re showing your employees that you care about their mental and physical well-being.

Three alternatives for small business health plans

Now, let’s explore three innovative alternatives to traditional health insurance that can provide quality care and cost-effective solutions for your small business.

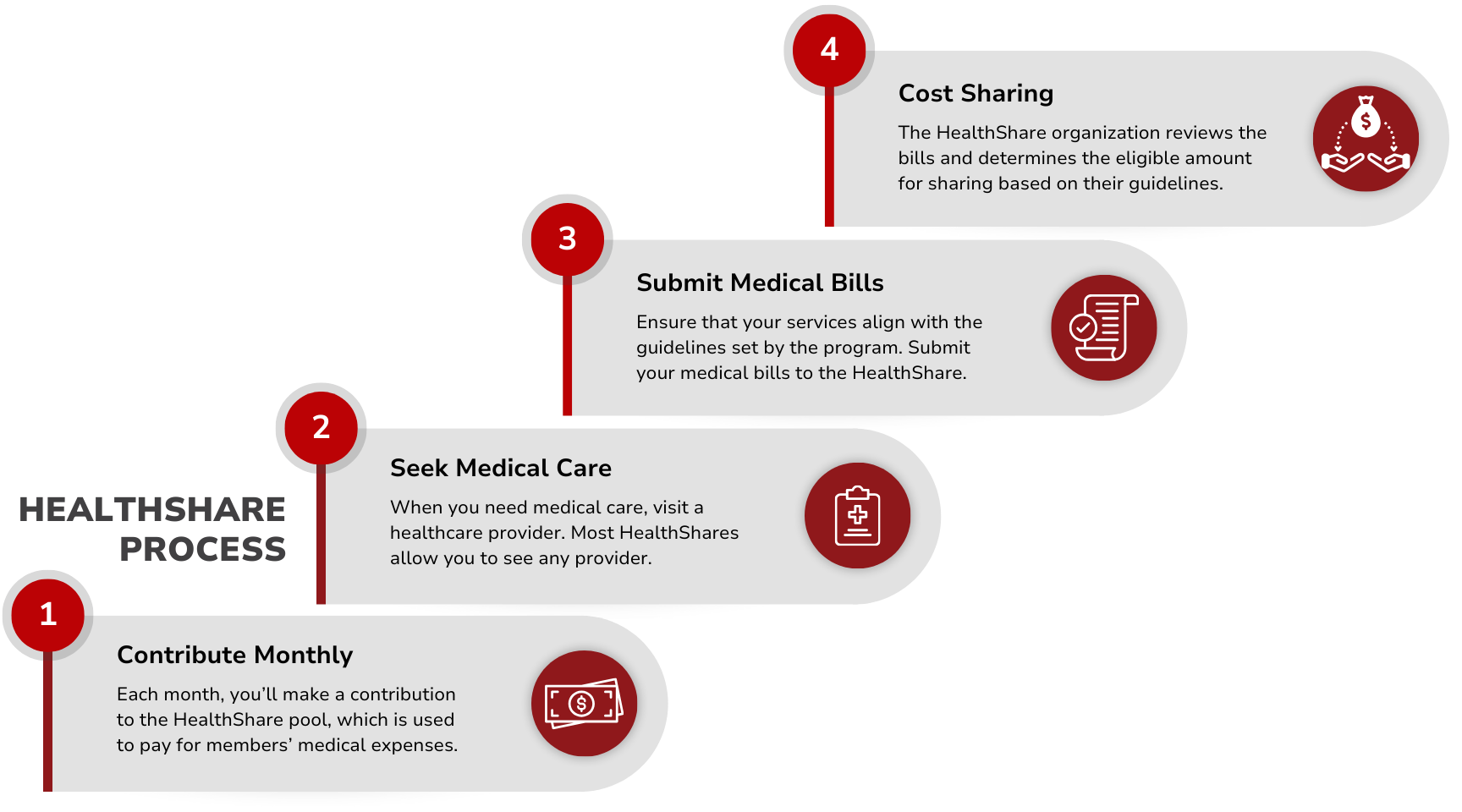

1. HealthShare Membership

HealthShare memberships are programs where members contribute monthly to share medical expenses. These programs, often run by nonprofit organizations, pool contributions to share members' healthcare costs.

Benefits

- Lower costs: Generally, HealthShare memberships have lower monthly contributions compared to traditional insurance premiums.

- Community support: These programs often foster a sense of community among members, who support each other’s medical needs.

- Flexibility:

HealthShare memberships can share in a wide range of medical expenses, including alternative and holistic treatments.

Considerations

- Though HealthShare memberships can assist with many medical costs, they are not insurance and may not share in all medical expenses.

- Though many HealthShares will assist with expenses related to pre-existing conditions, there may be limitations.

2. Direct Primary Care

Direct Primary Care (DPC) is a healthcare model where patients pay a flat monthly fee directly to their primary care provider for a range of services. This fee typically covers all primary care services, including routine checkups, chronic disease management, and preventive care.

Benefits

- Personalized care: DPC allows for longer, more personalized visits with your primary care provider.

- Cost transparency: The flat monthly fee ensures no surprise billing, and additional costs are communicated upfront.

- Accessibility: DPC often includes easier access to your doctor, including same-day or next-day appointments.

Considerations

DPC typically does not cover specialist care or hospitalizations, so it may need to be paired with a health plan or another form of catastrophic coverage.

What about alternative health plans for large businesses?

If you are a business owner with a larger group of employees, alternatives to traditional health plans may also benefit your business.

Adding non-traditional benefits to your benefits lineup can enhance your offerings without entirely replacing traditional plans. This approach is particularly beneficial for Applicable Large Employers (ALEs) who need to maintain compliance and may not want to move solely to these alternatives.

3. Virtual Care

Virtual care (also known as telehealth or telemedicine) provides medical consultations and healthcare services through digital communication tools like video calls, phone calls, or messaging apps. This model has grown significantly in popularity due to its convenience and effectiveness.

Benefits

- Convenience: Employees can access healthcare from the comfort of their home or workplace, reducing time off work for medical appointments.

- Lower costs: Virtual care often comes at a lower cost than in-person visits and can reduce overall healthcare expenses.

- Wide range of services: Telehealth can cover various services, including primary care, mental health, and specialist consultations.

Considerations

Not all medical conditions can be addressed remotely, so it might need to be part of a broader healthcare strategy.

Embracing innovative solutions

As a small business owner, balancing all your responsibilities while ensuring your employees are well taken care of can be challenging. Traditional health insurance might seem like the only option for your small business health plan, but it often comes with high costs, time-consuming management, and complex regulations. Thankfully, alternatives like HealthShare memberships, Direct Primary Care, and virtual care offer innovative and practical solutions.

Exploring these alternatives can lead to cost savings, simplified administration, and higher employee satisfaction. By offering flexible and modern healthcare options, you not only support your employees' well-being but also show them that you value their contributions to your business.

Take the time to consider these alternatives for your small business health plan and see how they can benefit your business and your team. Your employees deserve the best care, and with these alternatives, you can provide it without the traditional hassles.

Don't let traditional insurance options keep you from offering a small business health plan. Explore alternative benefits options that can unlock your business' potential.

For a closer look at how we can help your business create a benefits package that works for your team and your budget, click below.

Explore

SUGGESTED FOR YOU