Business Tax Incentives for Offering Employee Benefits

Employee benefits, a staple in modern business practices, are often perceived as a financial burden by small and medium-sized businesses. But here’s some good news: there are a lot of tax incentives out there to lighten the cost load of perks like health plans and retirement plans.

It’s a win-win: you as a business owner get to keep your team happy and motivated, and at the same time, the government gives you a financial pat on the back for doing so. Let’s take a look at some of these tax breaks and show how they can help your business do right by your team without breaking the bank.

Understanding employee benefits and tax deductions

Employee benefits include everything from health plans and retirement plans to paid sick leave and vacation time. For businesses, these benefits are not just tools for attracting talent but also opportunities for tax savings.

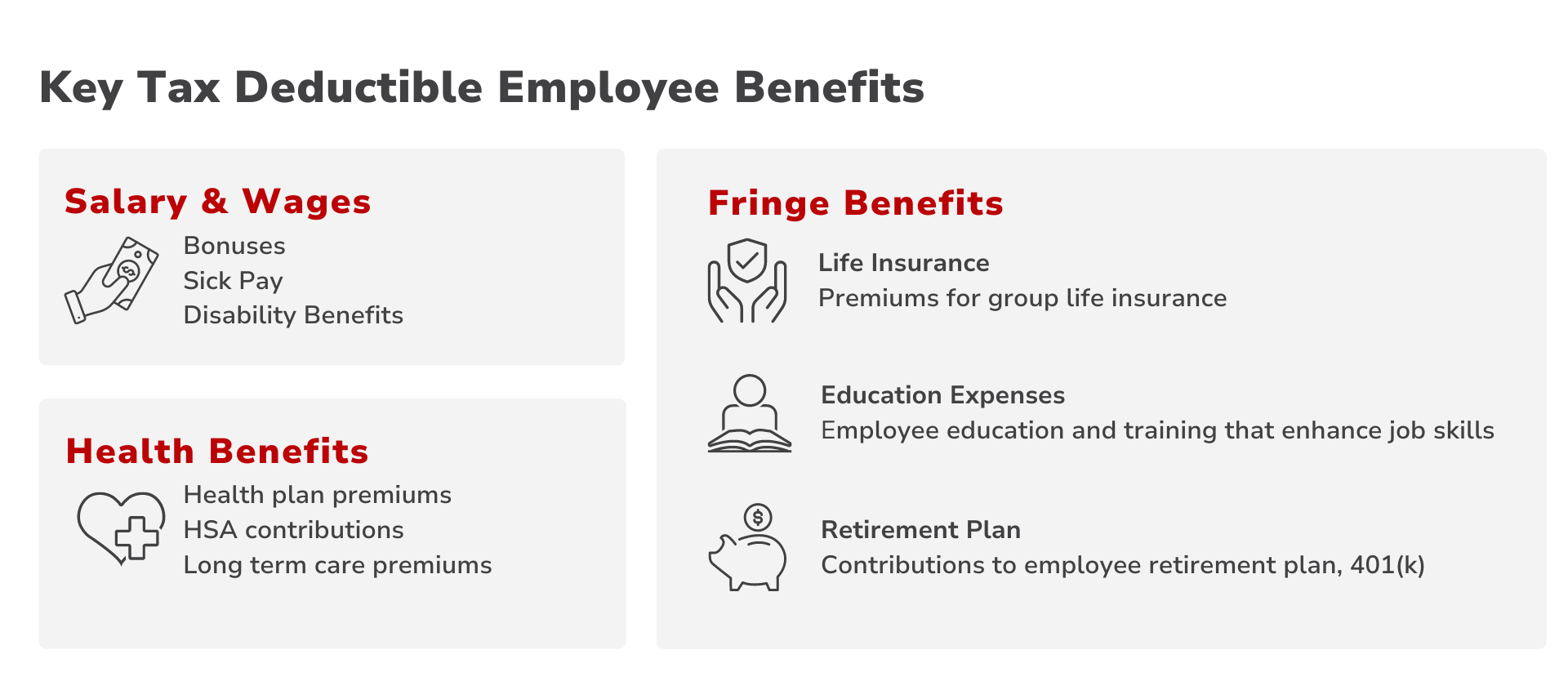

Here is a breakdown of key employee benefits that are tax deductible

Health Benefits

- Health Plans: Premiums paid for employee health, dental, and vision insurance

- Health Savings Account (HSA): Contributions made to an employee’s HSA

- Long-Term Care: Premiums paid for employees’ long-term care insurance

Salary & Wages

- Bonuses: Cash bonuses given to employees

- Sick Pay: Wages paid to employees during sick leave

- Disability Benefits: Cost of providing short-term or long-term disability benefits

Fringe Benefits

- Life Insurance: Premiums for group term life insurance (see below for applicable limits)

- Education Expenses: Costs for employee education and training that enhance job skills

- Retirement Plan Contributions: Contributions to employee retirement plans, like 401(k)

Complexity of deductions for employee benefits

There’s a lot to know when it comes to tax deductions for employee benefits, and to maximize your tax advantages while remaining compliant with IRS regulations, you’ll probably want to consult a professional. Here’s a closer look at navigating these complexities:

Valuing employee benefits for deduction purposes

The value of employee benefits for tax deduction purposes often depends on the type of benefit. For example, the cost of health plan premiums paid by the employer is generally the amount deductible. But for benefits like life insurance or the use of a company car, the IRS provides specific guidelines to determine the deductible value. In the case of retirement plan contributions, the deduction value is usually the amount contributed to the plans within that tax year.

Understanding limits and qualifications for deductions

There are caps and qualifications on deductions for certain benefits. For example, the deduction for group-term life insurance premiums is only up to the cost of $50,000 of coverage per employee. Contributions to retirement plans also have annual limits, beyond which they are not deductible. For health benefits, particularly in small businesses and S Corps, the deductibility can vary based on business structure and number of employees.

The role of fair market value in determining deductible amounts

Fair Market Value (FMV) plays an important role in determining the deductible amount for certain benefits. This is is the price that the benefit would sell for on the open market. For benefits like personal use of a company vehicle or housing provided by an employer, the FMV of the benefit must be determined and reported as part of the employee’s income. The employer can then deduct the cost of providing these benefits. All FMV figures used must be realistic and justifiable.

These more technical and nuanced aspects of employee benefits deductions require a thorough understanding of tax laws and often the guidance of a tax professional or third-party administrator.

By accurately valuing benefits and understanding the limits and qualifications for deductions, businesses can manage their tax liabilities and benefit from offering comprehensive benefits packages. Embracing these opportunities will not only improve your team’s morale and loyalty, but also solidifies your status as an appealing potential employer.

Legal disclaimer: This is not legal advice. For questions regarding your specific situation, please consult an attorney.

Explore

SUGGESTED FOR YOU