Strategies for Effective Health Plan Renewals

Renewal season rarely waits for a quiet calendar. As projects stack up, so do the questions. What do our people need most? Where are we paying too much? Mercer projects a 6.5 percent increase in employer health benefit costs in 2026, which can make open enrollment feel daunting.

In This Article

The good news is that a business health plan renewal is not just an annual chore. It is a strategic opportunity to protect employees from financial stress and to strengthen recruiting. When out-of-pocket costs like deductibles, coinsurance, and prescriptions rise, reliable and affordable benefits matter even more.

With the right preparation, renewal season can convert renewal pressure into clear decisions. In the sections below, we walk through five practical steps for a business health plan renewal that controls costs, supports employees, and keeps you compliant.

1. Start early and stay ahead

One of the best things that you can do for yourself, and your business, is to start planning early. Give yourself about 90 days before your effective date so you have space to compare options, negotiate, and communicate.

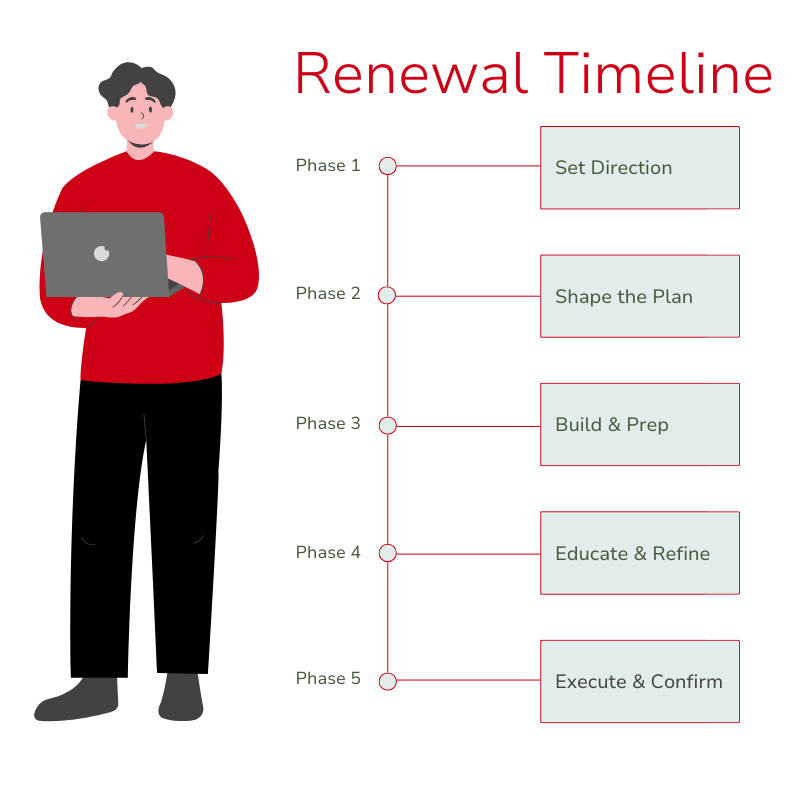

90-Day Blueprint:

- Phase 1: Set direction. Review renewal rates and projected costs. Confirm leadership goals and budget.

- Phase 2: Shape the plan. Discuss claims-fund activity, plan offerings, and employer contributions. Outline your open enrollment strategy.

- Phase 3: Build and prep. Configure plan changes in the enrollment system. Draft communications, FAQs, and a simple timeline.

- Phase 4: Educate and refine. Share materials. Hold presentations and one-on-one meetings. Capture questions and adjust messaging.

- Phase 5: Execute and confirm. Open enrollment, finalize elections, and queue payroll deductions and eligibility files. Spot-check for accuracy.

Similar to tax planning, the sooner you start, the more time you have to make smart adjustments. Starting early gives you breathing room, better conversations, and a smoother business health plan renewal for everyone.

2. Use data to drive smarter decisions

Data is the difference between guessing and making confident, defensible choices. If you don't already have access to claims data, request the data so that you can see where your dollars are going. This will help you understand and make projections for the year.

What to look for

When you review the data, start with the big drivers of cost like pharmacy, imaging, emergency room visits, and specialty care. Look at what employees are actually using so you can see which benefits are well loved and which benefits are barely touched. Then, step back and check for trends to understand whether this year is an outlier or part of a pattern. This data can help you better understand how to move forward with renewal strategies that keep costs in check and align with employee needs.

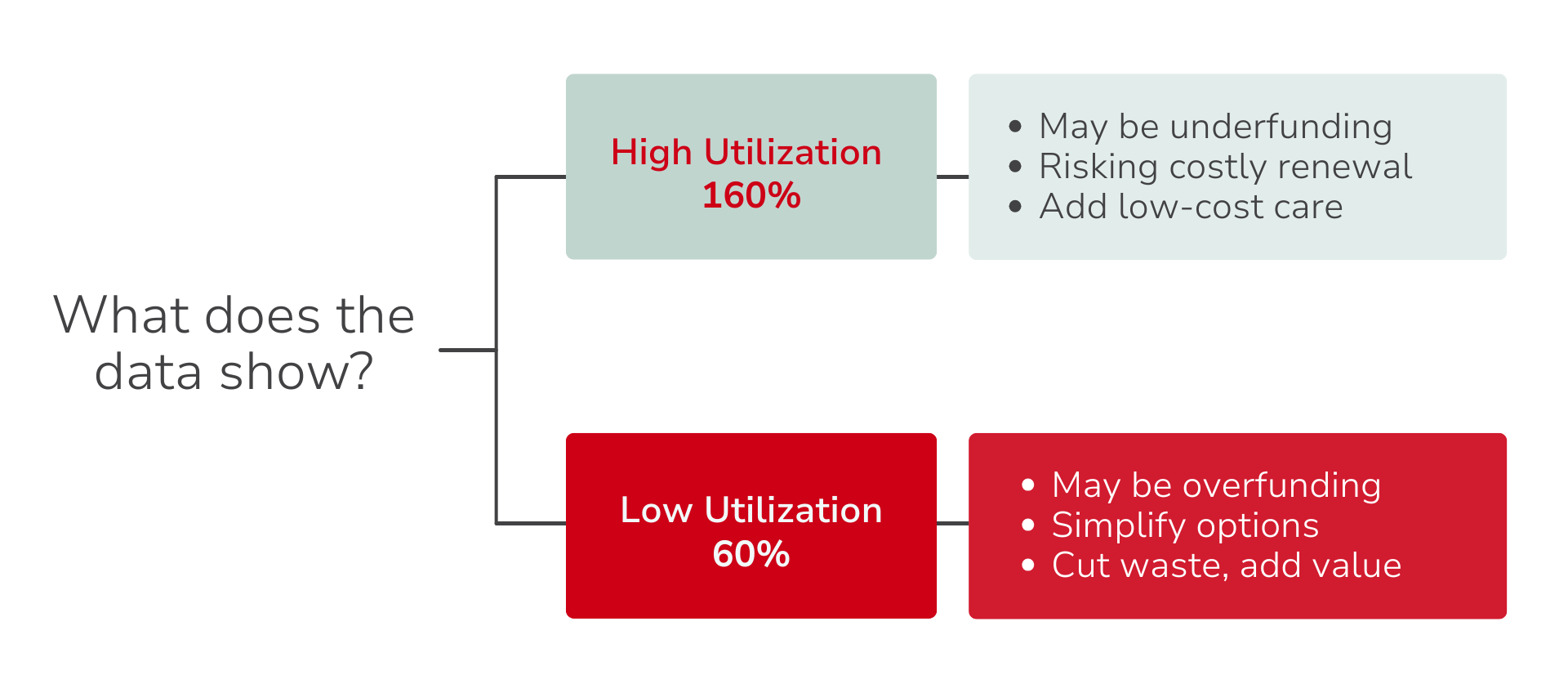

How to act on what you see

High utilization, such as 160%. Consider ways to make everyday care easier to reach and less expensive. Direct primary care, virtual visits, and clearer care navigation can all lower downstream costs while giving employees quicker support.

Low utilization, such as 60%. You may be overfunding the plan. At renewal, you could lighten contributions, simplify plan choices, or reinvest savings into benefits people are asking for, such as mental health resources or primary care access.

Bring employees into the picture

Numbers can show you where the dollars went, but employees can tell you which dollars actually mattered. Once you understand the cost drivers and underused benefits, reach out to employees to learn what was most valuable to them and where they may have felt gaps. A short survey or a quick feedback session is often enough to surface the benefits people rely on, the ones they find confusing, and the areas they would like to see improved.

When you pair utilization data with employee feedback, you can fine-tune your benefits strategy, so it supports the people who use it most, eliminates spending that isn’t serving them, and positions your business health plan renewal as both financially responsible and people centered.

3. Drive employee participation through communication

Great benefits only work when people use them. Many teams struggle to get employees to enroll or waive coverage, so make participation a priority and keep the process simple and supportive.

Key Drivers of Employee Participation

Participation increases when three things are clear: how much of the premium you cover, what the plan options and costs mean in plain language, and where employees can get personal help.

The more you contribute, the more affordable coverage becomes, which drives broader enrollment, creates a healthier risk pool that stabilizes costs year over year, and strengthens your edge in retention. Clarity matters just as much as contribution. When employees understand what is included and how to access it, they actually use their benefits. Offer live meetings and easy one-on-one support so people can ask questions, get personalized guidance, and choose with confidence.

Make Education Your Anchor

For many, benefits feel too complicated to attempt to understand. Start by making sure you fully understand the plan you offer, then share the essentials in a way that is easy to skim and easy to act on.

- Be upfront about what is changing and why.

- Spell out employee costs and employer contributions with simple examples.

- Show how to enroll or waive, where to get help, and the key dates.

- Highlight any nontraditional options that may be unfamiliar, like direct primary care or fair-priced healthcare. A quick explanation and a simple “how it works” goes a long way.

Clear, consistent communication builds confidence. Presentations and brief one-on-ones help employees choose the right option and actually use it. The more informed and supported your team feels, the smoother open enrollment will be, and the more stable your participation will remain throughout the year.

4. Optimize costs without sacrificing value

A well-planned business health plan renewal can control spending and improve the member experience at the same time. The goal is not to cut benefits. The goal is to invest in the options that deliver the most value for your team.

Proven Strategies to Consider:

- Direct Primary Care (DPC): Predictable access to primary care and fewer downstream high-cost claims.

- Care Coordination: Guides members to quality providers at fair, transparent rates, helps avoid surprise bills, and lowers total spending.

- Plan Design Adjustments: Offer tiered options to fit different needs. Align employer contributions to nudge smart choices.

- Preventive Care: Promote screenings and routine visits to catch issues early and reduce catastrophic claims later.

- Telehealth and Virtual Care: Convenient for common needs at a fraction of emergency room or urgent care costs.

One of our clients recently boosted plan participation from 41% to 61% by combining clear employee communication with more cost-efficient plan options. This shows that smart strategies can cut costs and boost satisfaction at the same time.

5. Ensure compliance and smooth operations

Small compliance misses and oversights can quickly turn into big headaches. But when compliance and operations are mapped out clearly, you can focus on running the business instead of fixing paperwork.

Compliance Must Haves

Compliance is a must-have during every business health plan renewal. At a basic level, you’ll want to make sure employees in the same class are being offered the same benefits, that Employer Shared Responsibility requirements (for both Part A and Part B of Section 4980H) are met where applicable, and that Section 125 paperwork is current for any pre-tax deductions. It’s also important to keep plan documents and notices updated each year so that employees always have accurate information to rely on. Taking the time to double-check these details helps you stay ahead of potential issues and protects your organization from penalties or employee frustration down the road.

Operations that Keep Things Smooth

Smooth operations are just as critical as compliance. Payroll deduction reports should be prepared and shared before the first payroll run to avoid surprises for both employees and accounting. Enrollments also need to sync correctly into your Human Resources information system (HRIS) or customer relationship manager (CRM) so that eligibility and deductions line up without manual fixes later. Once the plan year begins, reviewing the first invoice is a simple way to catch errors early. Beyond that, consider scheduling new-hire orientation and offering a quick “how to use your benefits” refresher for existing employees. These touchpoints give employees confidence and reduce the number of last-minute questions HR has to field. Finally, monthly or quarterly check-ins are a helpful way to keep tabs on new hires, terminations, and claims fund activity, while also gathering feedback to guide future improvements.

A structured business health plan renewal should bake-in compliance checks and operational guardrails. If your current process leaves you spending time chasing files or fixing invoices, tighten the handoffs. The right administrator will make these steps feel routine and low-effort.

Turning renewal into opportunity

Like any core process, benefits communication should be reviewed and refined. Track engagement across channels, measure which resources employees use most, and survey what was helpful or confusing. These insights allow you to adapt your strategy year after year.

Metrics like portal logins, video views, and email open rates reveal what captures attention. If engagement drops after open enrollment, consider adding lighter touchpoints throughout the year. Over time, you’ll discover the cadence and formats that resonate best with your workforce.

Need help with your benefits renewal? Have other benefits questions? Let’s talk.

Explore

SUGGESTED FOR YOU